In today’s high-speed trading environment, execution discipline separates professionals from hobbyists. Manual grid trading demands constant monitoring, emotional control, and precise risk calculation. That’s exactly why many fintech professionals are turning toward a structured Martingale EA to automate recovery logic and position scaling without hesitation or delay.

A properly engineered Martingale EA is not about reckless doubling. It’s about calculated lot progression, dynamic spacing, volatility awareness, and risk-managed grid deployment. When configured correctly, it transforms a stressful averaging strategy into a rule-based execution model aligned with defined parameters.

In this article, we’ll break down how a Martingale EA works, how Martingale Forex EA parameters affect performance, and how fintech professionals can deploy it responsibly within advanced trading frameworks.

Understanding the Core Logic Behind Martingale EA

At its foundation, a Martingale EA follows a structured lot progression system. When a trade moves into drawdown, the system opens additional positions at predefined distances, typically increasing lot size based on a multiplier. The objective is to reduce the overall break-even level and close the basket in profit once price retraces.

However, professional implementation goes far beyond simple lot doubling.

A modern Martingale EA integrates:

- Adjustable grid spacing

- Configurable lot multipliers

- Equity protection limits

- Spread filters

- Time-based trading controls

These elements prevent blind exposure and help adapt the strategy to different currency pairs and market conditions. The difference between failure and sustainability lies entirely in configuration discipline.

For fintech professionals, the strategy becomes a mathematical model rather than a gamble.

The Importance of Martingale Forex EA Parameters

One of the most critical aspects of using a Martingale EA effectively is understanding Martingale Forex EA parameters. These settings define the system’s risk behavior, profit targets, and capital exposure.

Let’s examine key parameters professionals must optimize:

1. Lot Multiplier

This determines how aggressively position size increases. A 1.2x multiplier behaves very differently from a 2.0x multiplier. Lower multipliers reduce drawdown pressure but require deeper retracement for basket closure.

2. Grid Distance

Tighter grids increase trade frequency but accelerate margin usage. Wider grids reduce exposure speed but may delay recovery. Market volatility should influence this setting.

3. Maximum Trades

Limiting the number of open positions protects account equity from runaway trends. Without this boundary, the system can exhaust margin during strong directional moves.

4. Basket Take Profit

Rather than closing individual trades, many Martingale systems target a collective profit level. This ensures efficient capital recycling.

5. Equity Stop / Drawdown Protection

This is non-negotiable for professional setups. Hard equity stops prevent catastrophic account wipeouts.

When fintech professionals approach Martingale Forex EA parameters analytically, they convert a high-risk strategy into a controlled algorithmic structure.

Risk Management: The Make-or-Break Factor in Martingale Automation

The biggest misconception around Martingale EA systems is that they are inherently dangerous. The reality? Misconfiguration is dangerous.

Professional traders understand that:

- Capital allocation must match maximum trade depth

- Leverage must be conservative

- Volatile news sessions require trade filtering

- Correlated pairs should not run identical grids simultaneously

A Martingale EA must operate within a defined capital envelope. For example, if back testing shows a worst-case 8-level grid, margin requirements must account for that full exposure scenario — not average conditions.

Fintech professionals often pair Martingale automation with:

- Volatility-based trade filters

- Trend detection algorithms

- Session-based activation windows

- Risk diversification across symbols

This layered risk approach transforms Martingale logic into a strategic recovery model rather than uncontrolled averaging.

MT4 vs MT5 Deployment: Platform Considerations

Platform infrastructure matters when deploying automation. The MT4 ecosystem remains widely adopted for legacy broker compatibility, while MT5 offers expanded order handling and faster strategy testing.

Professionals choosing a Martingale EA for MT5 benefit from:

- Multi-threaded backtesting

- Enhanced depth-of-market functionality

- Advanced optimization frameworks

- Better execution modeling

MT5 is particularly advantageous when testing Martingale Forex EA parameters across multiple scenarios, including variable spreads and tick modeling.

However, MT4 remains reliable for stable grid execution when supported by a high-quality VPS and optimized broker conditions.

The decision should align with infrastructure, not preference alone.

Real-World Application: When Does Martingale EA Perform Best?

Martingale-based grid systems perform optimally in:

- Range-bound markets

- Moderate volatility environments

- Currency pairs with cyclical retracements

They struggle during prolonged, aggressive trends without retracement.

Professionals therefore deploy Martingale EA systems on:

- Major pairs like EURUSD during stable macro conditions

- Asian session ranging environments

- Pairs with historical mean-reversion behavior

Combining the EA with trend filters dramatically improves performance sustainability. For instance, disabling entries during strong directional breakouts reduces deep grid exposure.

A Martingale EA should never operate blindly across all sessions and pairs.

Backtesting and Forward Testing: Non-Negotiable Steps

Before going live, fintech professionals must:

- Backtest across at least 3–5 years of historical data

- Stress-test during high-impact news periods

- Simulate widened spreads

- Evaluate worst-case drawdown scenarios

Forward testing on a demo or small live account validates execution quality under real broker conditions.

Pay close attention to:

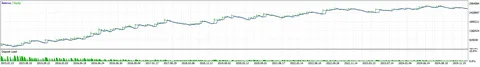

- Maximum consecutive levels triggered

- Margin utilization peaks

- Equity curve smoothness

- Recovery time duration

Optimization of Martingale Forex EA parameters must balance profitability and survivability. High monthly returns mean little if maximum drawdown threatens capital integrity.

Advanced Enhancements Professionals Use

Sophisticated users enhance Martingale EA frameworks with:

- Dynamic lot scaling based on ATR

- Adaptive grid spacing

- Hybrid martingale + anti-martingale layers

- AI-assisted volatility filters

These enhancements reduce static behavior and allow the EA to adapt to changing market conditions.

The goal is simple: minimize exposure acceleration while preserving recovery efficiency.

When engineered properly, Martingale automation becomes a precision risk-management engine rather than a speculative multiplier tool.

Conclusion: Martingale EA as a Strategic Automation Tool

A Martingale EA is not a shortcut to easy profits. It is a structured algorithm requiring disciplined parameter optimization, capital planning, and execution infrastructure.

For fintech professionals, the edge lies in configuration control — not aggressive multipliers. Understanding Martingale Forex EA parameters, implementing strict equity protection, and deploying platform-optimized infrastructure separates sustainable automation from account-destroying setups.

When treated as a mathematical recovery model within defined risk limits, Martingale automation becomes a powerful tool in the professional trader’s system architecture.

The real advantage is not doubling faster — it’s managing exposure smarter.