Author Introduction:

Hi everyone, I’m Michael, a seasoned investor with a passion for technology and growth stocks. Nvidia has been a major player in the chipmaking game for years, and I’ve been closely following their journey. Today, we’ll delve into whether it’s still a wise investment, based on analyst insights and key factors driving Nvidia’s growth.

Nvidia: Analysts Say It’s Not Too Late to Buy

The world of tech stocks can be a rollercoaster ride, and Nvidia (NVDA) has certainly been on a wild one. After a meteoric rise in recent years, some investors might wonder if the Nvidia train has already left the station. But fear not, tech enthusiasts! Many analysts believe there’s still plenty of room on board. Let’s explore why Nvidia might still be a compelling investment opportunity.

Nvidia’s Dominating Run: A Look Back

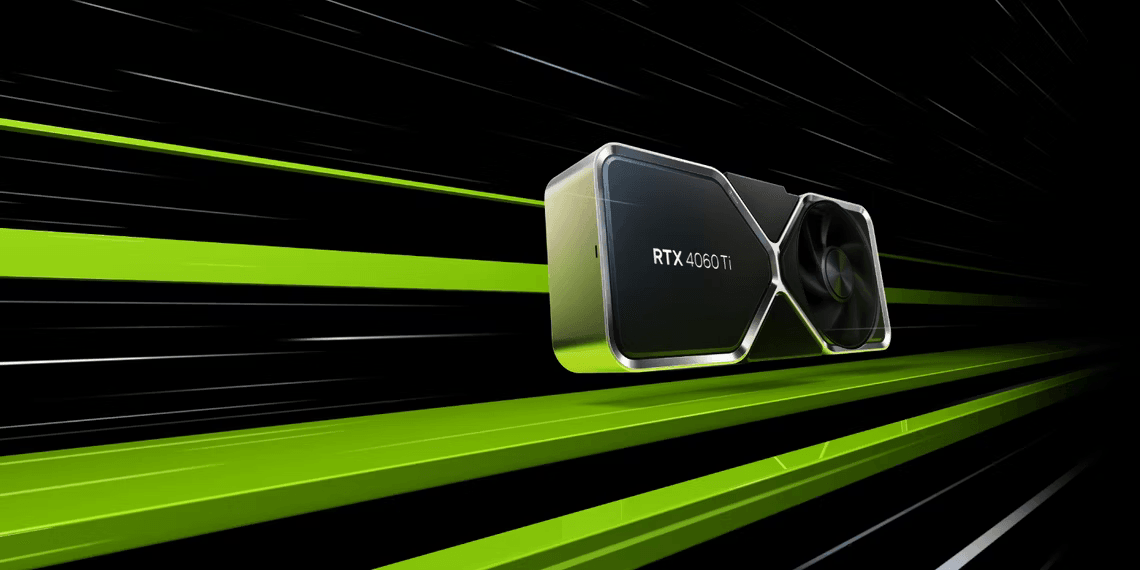

Nvidia has established itself as a titan in the graphics processing unit (GPU) market, powering the high-performance graphics cards coveted by gamers worldwide. But their reach extends far beyond gaming. Nvidia’s GPUs are also the workhorses behind the scenes of artificial intelligence (AI) development, data center operations, and even the burgeoning metaverse and virtual reality (VR) technologies. This diversification has fueled Nvidia’s impressive stock performance, with its value multiplying significantly in recent years.

Analyst Optimism: Why They Believe There’s Room to Grow

Despite the impressive run, analysts remain largely bullish on Nvidia. Here are some key reasons for their optimism:

- The Gaming Boom Shows No Signs of Slowing: The demand for powerful graphics cards continues to surge as PC gaming enjoys a golden age.

- AI Revolution Just Getting Started: Nvidia’s GPUs are perfectly positioned to capitalize on the ongoing explosion of AI applications across various industries.

- Data Centers Crave High Performance: The ever-growing need for data processing in data centers creates a steady demand for Nvidia’s high-performance computing solutions.

- Metaverse & VR: A New Frontier: The potential of these immersive technologies opens up entirely new markets for Nvidia’s powerful graphics processing capabilities.

- Autonomous Vehicles: A Future Market: The development of driverless cars necessitates the use of powerful processors, potentially creating another lucrative avenue for Nvidia.

Decoding the Hype: Key Drivers Behind Nvidia’s Success

The factors mentioned above paint a clear picture: Nvidia sits at the intersection of several high-growth trends. Here’s a deeper dive into why these trends translate to success for Nvidia:

- Gaming: The rise of eSports and graphically demanding games continues to fuel demand for Nvidia’s top-tier GPUs.

- AI Revolution: Nvidia’s GPUs are specifically designed for complex AI workloads, making them a preferred choice for developers and researchers.

- Data Center Growth: The ever-increasing volume of data processed in data centers demands efficient and powerful solutions, which Nvidia delivers through their GPUs.

- Metaverse & VR: As these technologies mature, the need for high-fidelity graphics processing will become even more crucial, giving Nvidia a significant advantage.

- Autonomous Vehicles: The development of self-driving cars necessitates real-time processing of vast amounts of data, a challenge Nvidia’s GPUs are well-suited to address.

A Comparative Look: Nvidia vs. AMD

| Feature | Nvidia | AMD |

|---|---|---|

| Market Share (GPUs) | 80% | 20% |

| AI Performance | High | Moderate |

| Manufacturing Partners | Strong Network (TSMC, Samsung) | More Limited Partners (TSMC) |

| Product Diversification | Diverse (Gaming, AI, Data Center) | More Focused (Gaming, CPUs) |

While Nvidia is a dominant player, it’s not the only player in the game. Including a table comparing Nvidia to its key competitors in terms of market share, AI performance, manufacturing partnerships, and product diversification would provide valuable insights for investors.

Investing in Nvidia: Weighing the Risks and Rewards

No investment is without risk. Here are some potential challenges to consider when evaluating Nvidia:

- Economic Downturn: A broader economic downturn could dampen consumer spending on gaming hardware and other sectors that rely on Nvidia’s technology.

- Increased Competition: The chipmaking industry is highly competitive, and new players could emerge to challenge Nvidia’s dominance.

- Technological Disruption: The rapid pace of technological advancement could lead to unforeseen disruptions that could impact Nvidia’s products.

Making an Informed Decision: Tips for Nvidia Investors

Before diving into any investment, thorough research is crucial. Here are some tips for those considering Nvidia stock:

- Research the Company: Delve deeper into Nvidia’s financials, business model, and future plans.

- Understand Your Risk Tolerance: Investing in any stock carries inherent risk. Be honest with yourself about how much risk you’re comfortable with.

- Develop a Long-Term Strategy: Don’t chase short-term gains. View Nvidia as a potential long-term holding that aligns with your overall investment goals.

Conclusion: Is Nvidia Still a Buy for You?

The future of technology is undeniably intertwined with advancements in processing power. Nvidia, with its cutting-edge GPUs, stands at the forefront of this revolution. While economic downturns, increased competition, and unforeseen technological disruptions pose potential challenges, Nvidia’s position at the intersection of high-growth trends like AI, gaming, and data center needs makes it a compelling company to consider.

By carefully analyzing analyst insights, conducting thorough research into Nvidia’s financials and future plans, and understanding your own risk tolerance, you can make an informed decision about whether Nvidia aligns with your long-term investment goals. Remember, investing carries inherent risk, and diversification is key. However, for those seeking exposure to the exciting world of AI, gaming, and the future of computing, Nvidia might be a stock worth exploring.