In the vast landscape of advanced materials, certain substances capture the imagination while others work quietly behind the scenes, enabling technologies we rarely think about. Hexagonal boron nitride belongs firmly in the second category—largely unknown outside scientific and industrial circles, yet essential to innovations shaping our future. Engineers sometimes call it “white graphene,” a nickname that hints at its extraordinary nature without revealing the full story.

This material performs a balancing act that seems almost magical. It moves heat as efficiently as copper while blocking electricity completely. It withstands temperatures that would reduce most substances to ash. It provides lubrication in environments where conventional oils would vaporize or freeze. These seemingly contradictory properties explain why industries from electronics to aerospace continue finding new uses for this remarkable compound.

The market reflects this growing appreciation. According to recent analysis from Kings Research, the global hexagonal boron nitride market reached approximately $878.5 million in 2022. By 2030, researchers project this figure will climb to $1.33 billion, representing steady annual growth of 5.42 percent throughout the forecast period. These numbers translate into real-world impact—better performing electronics, more efficient vehicles, and longer-lasting industrial equipment.

The Science Behind the Magic

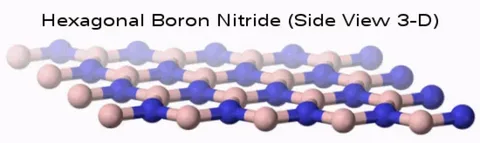

Understanding why hexagonal boron nitride generates such excitement requires a brief journey into atomic architecture. Imagine taking the structure of graphite—those layered sheets that make pencil lead write so smoothly—and replacing every carbon atom with alternating boron and nitrogen atoms. This simple substitution transforms the material’s properties in profound ways.

The strong chemical bonds holding each layer together create remarkable thermal conductivity. Heat travels through hexagonal boron nitride almost as easily as through some metals, yet the electronic structure prevents electrons from following that same path. This combination proves invaluable for managing heat in sensitive electronic devices where electrical isolation remains essential.

Between the layers, weaker forces allow sheets to slide past one another with minimal resistance. This characteristic makes hexagonal boron nitride an exceptional solid lubricant, functioning under high temperatures or vacuum conditions where traditional liquid lubricants fail completely. Spacecraft mechanisms, for example, often rely on this property to operate reliably in orbit.

The material’s thermal stability deserves special mention. While many compounds decompose or oxidize at high temperatures, hexagonal boron nitride maintains its integrity under conditions that would destroy alternatives. This resilience opens applications in furnaces, engines, and other extreme environments where material failure isn’t an option.

How Industries Put These Properties to Work

Electronics manufacturers have become particularly enthusiastic adopters. As devices shrink and processing power increases, managing waste heat becomes increasingly difficult. Traditional cooling approaches struggle to keep up, creating demand for materials that efficiently conduct heat away from sensitive components while preventing electrical shorts. Hexagonal boron nitride fills this role beautifully, often incorporated into thermal interface materials, circuit board substrates, and chip packaging.

The aerospace sector values the material for entirely different reasons. Aircraft engines operate at temperatures approaching the limits of what metals can withstand. Adding hexagonal boron nitride to ceramic matrix composites helps these components survive extreme thermal conditions while reducing weight compared to all-metal alternatives. Spacecraft benefit from its lubricating properties in mechanisms exposed to vacuum, where conventional greases would evaporate or freeze.

Electric vehicle manufacturers represent a growing customer base. Battery packs require careful thermal management to maintain performance and prevent dangerous failures. Power electronics converting electricity between battery and motor generate significant heat that must be removed efficiently. Electric motors themselves benefit from lubricants capable of handling extreme conditions. Each application creates opportunities for hexagonal boron nitride solutions.

The cosmetics industry might seem an unlikely destination for advanced ceramic materials, yet premium makeup products frequently contain hexagonal boron nitride. Its platelet structure provides smooth application, while its optical properties create the soft-focus effect consumers associate with high-end formulations. The material’s chemical inertness ensures it won’t react with skin or other ingredients, making it ideal for sensitive applications.

The Companies Shaping This Market

Competition in the hexagonal boron nitride space brings together established chemical giants and specialized niche players, each contributing unique strengths to the market ecosystem.

Denka Company Limited has built its position through decades of experience in chemical manufacturing, producing consistent, high-quality material that customers can rely on for demanding applications. Momentive Technologies brings deep materials science expertise, applying sophisticated understanding of ceramic processing to create specialized grades that solve specific customer problems.

Kennametal approaches the market from its foundation in metalworking and wear-resistant components. The company understands firsthand how boron nitride’s lubricating properties extend tool life and improve manufacturing precision. This application knowledge informs product development and customer relationships.

Resonac Holdings Corporation, operating under its new name after years as Showa Denko, contributes specialized knowledge of semiconductor materials. The electronics industry’s demanding purity requirements and precise specifications align with the company’s technical capabilities and quality systems.

European manufacturers bring regional specialization to the market. Henze Boron Nitride Products AG develops customized solutions for specific customer requirements, building close relationships that generalist competitors cannot match. Höganäs AB applies its powder metallurgy expertise to boron nitride production, serving industrial customers across Europe. Saint-Gobain, with its vast materials science resources, maintains a broad product portfolio serving multiple industries simultaneously.

Smaller players demonstrate that opportunities exist beyond the industry leaders. Grolltex Inc focuses specifically on two-dimensional materials, applying specialized knowledge to niche applications. Supervac Industries LLP serves regional markets with responsive service and appropriate product offerings. Companies like UK Abrasives, ZYP Coatings, and Precision Ceramics Europe Limited show how hexagonal boron nitride supports diverse industries through specialized applications.

This competitive diversity benefits customers by ensuring multiple supply sources, encouraging continuous innovation, and maintaining pressure on both pricing and quality. For companies considering entry into this space, understanding how different competitors position themselves proves essential for identifying underserved segments and differentiation opportunities.

What’s Driving Market Growth

Several powerful forces are converging to accelerate hexagonal boron nitride adoption across multiple industries. Understanding these drivers helps explain why market projections remain consistently optimistic.

The relentless miniaturization of electronics continues creating thermal management challenges that demand innovative solutions. Each generation of devices packs more processing power into smaller volumes, concentrating heat in ways that overwhelm conventional cooling. Materials that conduct heat efficiently while maintaining electrical isolation become increasingly essential as this trend continues.

The transition to electric vehicles represents perhaps the most significant growth opportunity. Every electric vehicle contains multiple systems that benefit from hexagonal boron nitride properties. Battery thermal management systems require materials that transfer heat without conducting electricity. Power electronics need substrates that handle high voltages while dissipating waste heat. Drive motors benefit from lubricants capable of performing under extreme conditions. As electric vehicle production scales from millions to tens of millions annually, demand for these applications will scale correspondingly.

Aerospace and defense applications continue driving demand at the high-performance end of the market. Next-generation aircraft operate at temperatures that push material limits. Hypersonic vehicles face conditions that would destroy conventional materials. Space systems must function reliably in environments where maintenance is impossible. Hexagonal boron nitride’s combination of thermal stability, lubricity, and dielectric properties makes it valuable across these demanding applications.

The cosmetics industry’s steady growth adds another demand source that, while less dramatic than electric vehicles, provides consistent consumption. As global personal care markets expand and consumers demand higher-performing products, manufacturers incorporate advanced materials like hexagonal boron nitride to deliver the texture, application, and appearance that justify premium pricing.

Understanding Market Segmentation

Breaking the market into segments reveals where opportunities concentrate and how different customer groups prioritize different attributes.

By grade, the market divides into premium and standard categories. Premium grades command significantly higher prices and serve applications where purity, consistency, and specific properties prove critical. Semiconductor manufacturing requires material free from contaminants that could affect device performance. Aerospace components demand consistent behavior under extreme conditions. High-end cosmetics need predictable texture and optical performance. Standard grades find applications in lubricants, general industrial uses, and products where minor variations cause minimal impact.

By end-use industry, the market shows where suppliers should focus their development and marketing efforts. Electronics and semiconductor applications demand the highest purity and most consistent quality, justifying premium pricing for suppliers who can meet these requirements. Aerospace and defense customers prioritize reliability above cost, creating opportunities for suppliers willing to navigate complex qualification processes. Automotive applications, particularly in electric vehicles, offer volume potential that justifies investment in production capacity and cost optimization. Healthcare applications, including dental materials and medical devices, require biocompatibility and regulatory compliance expertise that create barriers to entry and protect margins.

Geographic Patterns and Regional Opportunities

Regional analysis reveals distinct consumption patterns and growth trajectories that matter for companies planning market entry or expansion.

North America maintains a strong market position driven by aerospace, defense, and semiconductor industries. Established manufacturers serve sophisticated customers with demanding specifications. Research institutions continue advancing materials science, creating pipelines for new applications and improved production methods. The region’s intellectual property protection and developed infrastructure support continued innovation..

Asia Pacific represents the most dynamic growth region and increasingly the center of gravity for global production and consumption. China’s industrial expansion creates massive demand across multiple applications, from electronics manufacturing to automotive production. Japan’s semiconductor and electronics industries require high-purity materials for precision manufacturing. South Korea’s position in electronics and electric vehicles generates steady consumption growth. India’s expanding industrial base adds demand across application categories as manufacturing capacity develops. The region’s combination of production capability and consumption growth makes it central to market expansion strategies.

Latin America and Middle East & Africa currently represent smaller markets but offer growth potential as industrialization continues. Brazil’s aerospace industry creates demand for high-performance materials. Middle Eastern diversification efforts are building industrial capabilities that will eventually require advanced material inputs. African infrastructure development may create future opportunities for suppliers willing to invest in these regions before markets fully develop.

Navigating an Uncertain Future

Despite positive growth projections, market participants must prepare for potential disruptions and challenges. Regulatory changes affecting chemical manufacturing could impact production costs or availability. Trade policies and tariffs may disrupt established supply chains that span multiple countries. Economic fluctuations affect industrial activity and, consequently, material demand. Technological alternatives could potentially replace boron nitride in some applications if researchers develop superior solutions.

Successful companies address these uncertainties through strategic diversification. They serve multiple industries rather than depending on any single sector for the majority of revenue. They maintain relationships with suppliers across different regions to ensure supply continuity regardless of local disruptions. They invest in research that identifies new applications and improves production efficiency, creating options for future growth. They monitor regulatory developments and adapt proactively rather than reacting to changes after they occur.

What This Means for Different Stakeholders

For companies already active in hexagonal boron nitride markets, the growth outlook suggests opportunities for strategic expansion. Increasing production capacity ahead of demand requires capital investment but positions companies to capture market share as consumption grows. Developing premium grades for demanding applications improves margins and strengthens customer relationships. Expanding geographic presence, particularly in fast-growing Asian markets, opens new revenue streams and reduces dependence on any single region.

For investors evaluating opportunities, the steady growth projected through 2030 suggests patient capital can generate attractive returns. Understanding which segments grow fastest and which companies position themselves best for that growth enables informed investment decisions. The material’s essential role in enabling technologies—from electric vehicles to advanced electronics to aerospace systems—provides confidence that demand reflects structural trends rather than temporary fads that could reverse unexpectedly.