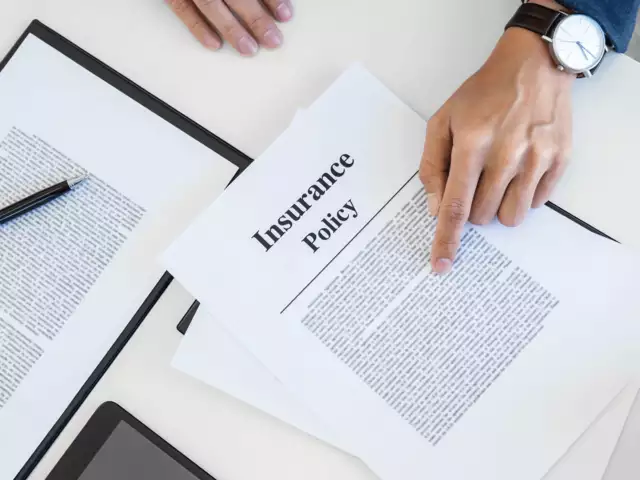

Introduction:

Porting your health insurance policy is a strategic move, but ensuring a smooth transition requires careful consideration. This article provides crucial tips to avoid claim rejections in the future. From documentation guidelines to strategic timing, follow these recommendations for a successful health insurance policy port.

Understand the Porting Process: A Comprehensive Overview:

Before diving into the tips, it’s crucial to have a clear understanding of the health insurance policy porting process. Familiarize yourself with the steps involved, the documentation required, and the timelines to make informed decisions.

Tip 1: Start the Process Early – Timing is Key:

Commence the porting process well in advance of your current policy’s expiration. Initiating the process early allows for thorough scrutiny, ensuring a seamless transfer without any coverage gaps. Late applications may face delays and complications.

Tip 2: Review and Update Your Medical Records:

Ensure your medical records are up-to-date. Any discrepancies or outdated information could lead to claim rejections. Request a comprehensive medical report and update your insurer with accurate health details during the porting process.

Tip 3: Provide Full and Accurate Disclosure:

During the porting application, honesty is paramount. Disclose all pre-existing conditions, medical history, and other relevant information truthfully. Failure to provide accurate details may result in claim rejections in the future.

Table: Key Documentation Checklist for Health Insurance Policy Porting:

| Document | Purpose | Additional Tips |

|---|---|---|

| Existing Policy Document | Reference for Coverage Details | Ensure You Have a Clear Copy |

| KYC Documents (ID, Address Proof) | Policyholder Verification | Keep Updated Copies for Reference |

| Medical History and Reports | Comprehensive Health Record | Include Recent Reports for Accuracy |

| Porting Application Form | Formal Request for Policy Transfer | Double-Check for Completeness |

| Renewal Notices and Premium Payment Receipts | Proof of Current Policy Status | Include Multiple Renewal Notices for Clarity |

Tip 4: Understand Waiting Periods and No-Claim Bonuses:

Take note of waiting periods for specific conditions in the new policy. Understand how the waiting periods align with your existing coverage to maximize benefits. Additionally, inquire about the transferability of any accumulated no-claim bonuses.

Tip 5: Maintain Continuous Coverage:

Avoid any gaps in coverage during the porting process. Ensure that your new policy becomes active immediately after the expiration of the existing one. This continuity is crucial to prevent claim rejections due to a break in coverage.

Tip 6: Seek Professional Guidance if Needed:

If the process seems complex or if you have specific health concerns, consider seeking assistance from a professional insurance advisor. Their expertise can help you navigate intricacies and ensure a successful policy porting experience.

Conclusion: Navigating the Porting Process with Confidence:

Porting your health insurance policy is a strategic move, and with the right approach, it can be a seamless process. This article has provided essential tips to avoid claim rejections in the future. From understanding waiting periods to maintaining accurate documentation, follow these guidelines to ensure a smooth transition and continued financial protection for your health needs.