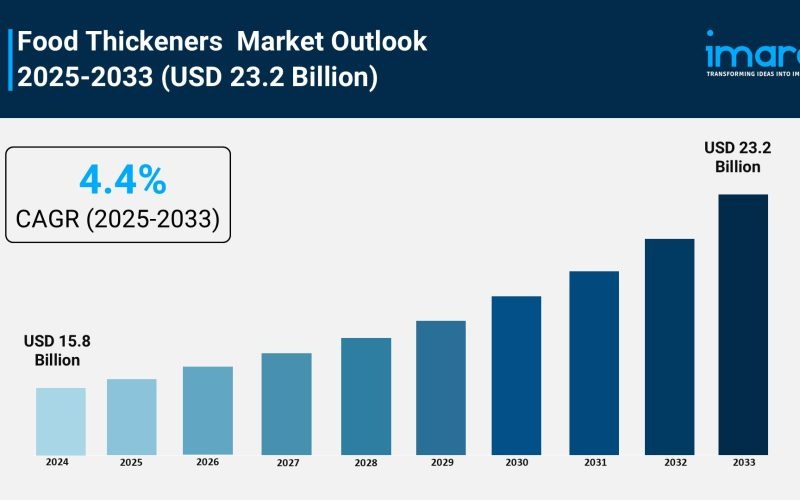

The food thickening agent market is on an exciting trajectory, with significant growth forecasts in the coming years. According to IMARC Group’s latest research publication titled “Food Thickeners Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033,” the global market size reached USD 15.8 billion in 2024. Projections indicate that this number could soar to USD 23.2 billion by 2033, reflecting a compound annual growth rate (CAGR) of 4.4% during the 2025-2033 period.

This report dives deep into a host of factors that influence market trends, such as industry size, business dynamics, regional forecasts, and the competitive landscape. By providing a thorough overview, it integrates findings from various sources and presents a clear view of market dynamics, including drivers, challenges, and growth opportunities. The analysis also highlights financial insights and technological advancements that are shaping the future of food thickeners.

The Role of AI in the Food Thickeners Market

Artificial Intelligence (AI) plays a transformative role in food production, particularly in the thickening agent sector. Utilizing predictive analytics and machine learning, companies can optimize their formulations, often reaching desired textures with 15-20% less material. This not only reduces waste but also enhances the efficiency of the production processes.

For instance, Ingredion operates AI-powered Idea Labs that facilitate co-creation of recipes with customers, allowing for rapid product development tailored to specific needs. Such innovations enable better customization of thickening solutions, making them versatile across various applications.

Moreover, advanced algorithms can analyze molecular compositions to discover new natural thickeners derived from plant-based sources. Companies like Brightseed leverage their AI platform, Forager, to identify bioactive compounds that can serve as effective thickening agents.

AI-driven systems also improve consistency in product quality. By minimizing batch variations by 25%, these systems ensure uniform texture in food and beverage applications. Additionally, machine learning models are able to predict consumer preferences, paving the way for the development of plant-based thickeners that address the needs of 78% of consumers willing to pay a premium for quality.

Key Trends Shaping the Food Thickeners Market

- Rising Demand for Clean-Label and Natural Thickeners:

The consumer landscape is increasingly shifting towards natural ingredients. As people become more health-conscious, the demand for clean-label products is skyrocketing. Approximately 64% of American consumers actively seek products containing natural thickeners, marking a substantial increase from 53% in 2022. The clean-label segment is thus witnessing rapid double-digit growth. - Growth in Plant-Based Food Applications:

The burgeoning plant-based food market creates exciting opportunities for thickeners. Innovations in areas such as dairy alternatives and vegan products are particularly noteworthy. The US plant-based food market grew by 14% in 2023, reaching USD 8.3 billion. Notable products like Tate & Lyle’s PROMITA F200 enhance the texture of plant-based yogurts and beverages, catering to the evolving palate of consumers. - Technological Advancements in Thickener Formulations:

Technological innovation is key to meeting the changing demands of the market. For example, Cornell University has developed 3D-structured starch particles that achieve the same thickening effect while using 50% less starch. Esto lowers calories and carbs, appealing to health-conscious consumers. Moreover, Ingredion’s introduction of HOMECRAFT pulse flours and starches from lentils, chickpeas, and yellow peas in February 2024 reflects the demand for clean-label options that don’t compromise quality. - Increased Focus on Functional Foods:

The functional foods market, expected to grow at 5.7% annually, will touch USD 368.9 billion by 2032. Foods that provide additional health benefits are gaining traction, driving demand for thickeners in products like yogurts, smoothies, and fortified beverages. Nearly 42% of consumers reported buying more functional foods in 2021, with thickeners playing a crucial role in both texture and nutritional incorporation. - Expansion in Dysphagia Treatment Solutions:

The growing prevalence of dysphagia, which affects 15% of individuals over 65 in North America, is fostering demand for medical-grade thickeners. Companies like Nestlé Health Science are diversifying their portfolios to include specialized nutrition products, responding to the needs of 82% of dysphagia patients who use food thickeners regularly.

Growth Drivers in the Food Thickeners Market

- Surging Demand for Convenience Foods:

As consumers increasingly seek convenience, the market for ready-to-eat meals and processed foods is surging. In the United States, convenience food sales grew by 7.2% in 2023, reaching an impressive USD 162 billion. Approximately 72% of these products use food thickeners to enhance texture and stability. - Health-Conscious Consumer Trends:

The focus on health and wellness is a significant driver of growth. The gluten-free product industry, estimated to reach USD 39.0 billion by 2032, is projected to grow at 7.1% annually. Increasing prevalence of celiac disease affects millions globally, accentuating the importance of gluten-free thickeners. - Bakery and Confectionery Industry Expansion:

The bakery segment is a major player in the food thickeners’ landscape, accounting for 25-30% of total market share. The demand for products like cupcakes, muffins, and pastries is growing, making thickeners essential for moisture retention and extended shelf life. - Technological Advancements in Food Processing:

New extraction methods and microencapsulation technologies enhance the effectiveness and cost-efficiency of thickeners. These innovations facilitate better integration of thickeners into diverse food products while reducing production costs by 10-15%. - Growing E-commerce and Direct-to-Consumer Channels:

The expansion of online platforms is making specialty thickeners—including gluten-free, organic, and non-GMO products—more accessible. E-commerce is rapidly growing, driven by consumer preference for convenience and competitive pricing.

Leading Companies in the Food Thickeners Sector

The landscape of the food thickeners market is populated by several key players, including:

- Archer Daniels Midland Company

- Ingredion Incorporated

- Tate & Lyle Plc.

- Cargill Incorporated

- DuPont De Nemours Inc.

These companies are pivotal in shaping the market trends, focusing on innovations and strategic advancements that meet current consumer demands.

Recent Developments in the Food Thickeners Market

- February 2024: Ingredion debuted HOMECRAFT pulse flours and starches derived from legumes, addressing the need for clean-label thickeners.

- June 2024: The company also announced a clean-label tapioca starch, aligning with growing consumer preferences for natural and allergen-free products.

- January 2025: Solina expanded its U.S. presence by acquiring Advanced Food Systems Inc., enhancing its offerings of customized ingredient systems for various applications.

Conclusion

The food thickeners market is witnessing transformative changes driven by consumer preferences, innovative technology, and a myriad of factors that highlight the significance of this sector. As companies continue to adapt and innovate, the market is poised for sustained growth, creating opportunities for both new and existing players.