Introduction

The price of Ethereum has always been one of the most closely watched in the cryptocurrency market. As the second-largest cryptocurrency by market capitalization, ETH price movements often set the tone for the broader crypto space. With increasing adoption of Ethereum’s blockchain and the rapid evolution of decentralized applications (dApps), understanding the potential future of Ethereum price is crucial for investors, traders, and enthusiasts alike.

This article explores the latest ethereum price prediction with a detailed look at bullish and bearish scenarios, combining key insights to help readers navigate the volatile market waters with confidence.

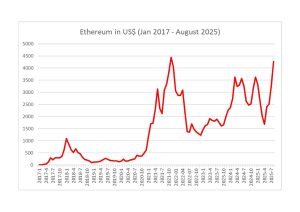

Current Ethereum Price Landscape

Ethereum is more than just a cryptocurrency; it is the foundation for a vast ecosystem of dApps, decentralized finance (DeFi) projects, and non-fungible tokens (NFTs). The ongoing upgrades to Ethereum’s network, such as the transition to Ethereum 2.0 and the introduction of proof-of-stake (PoS), have significant implications for ETH price. These changes aim to enhance scalability, reduce energy consumption, and improve transaction speed, making the network more attractive for large-scale adoption.

As of now, ETH price fluctuates in response to market demand, regulatory news, technological advancements, and macroeconomic trends. While volatility is expected, the question remains: where is the ETH price headed in the near and long term?

Bullish Ethereum Price Prediction Scenarios

Several factors could drive Ethereum’s price to new heights in the coming years:

- Ethereum 2.0 and Network Upgrades: The full implementation of Ethereum 2.0 promises to significantly improve network efficiency and lower gas fees, attracting more users and developers. As Ethereum becomes more scalable and environmentally friendly, investor confidence is likely to rise, pushing the ETH price upward.

- Expansion of Decentralized Finance (DeFi): DeFi protocols built on Ethereum continue to grow exponentially, facilitating borrowing, lending, and trading without intermediaries. This increased utility directly supports demand for ETH, which is used for transaction fees and staking.

- Corporate and Institutional Adoption: Big players, including enterprises and financial institutions, are increasingly integrating with Ethereum’s blockchain. The rising interest from institutional investors could boost ETH price as capital inflows increase.

- NFT and Metaverse Growth: Ethereum remains the backbone for most NFT and metaverse projects. As these markets mature and expand, transactional demand for ETH and its utility in virtual environments could spark major price increases.

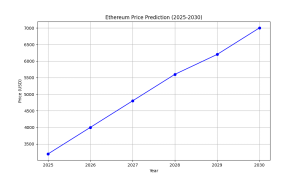

Considering these points, bullish analysts predict ETH price reaching anywhere from $5,000 to $10,000 by 2030, driven by robust adoption and innovation within the Ethereum ecosystem.

Bearish Ethereum Price Prediction Scenarios

Despite strong potential, there are risks that could create downward pressure on ETH price:

- Competition from Other Blockchains: Emerging blockchains like Solana, Cardano, and Avalanche offer faster transactions and lower fees, potentially drawing developers and users away from Ethereum, which could hurt ETH demand.

- Regulatory Challenges: Increased scrutiny by governments around the world concerning cryptocurrencies and DeFi could impact Ethereum negatively. Regulatory crackdowns or unfavorable policies could introduce uncertainty, depressing ETH price.

- Delays or Issues in Upgrades: If Ethereum 2.0 rollout faces significant delays or technical issues, confidence in the network could erode. This might push investors toward alternative blockchains.

- Market Volatility and Economic Factors: Broader financial market downturns, inflation concerns, or shifts in investor sentiment could exacerbate ETH price volatility and lead to sizable declines.

In bearish scenarios, ETH price might struggle to maintain above its current levels, with some forecasts suggesting drops below $1,000 if multiple risk factors materialize.

What Traders and Investors Should Consider

Navigating ETH price on the edge requires a balanced view of both bullish and bearish factors. Here are some key considerations:

- Stay informed about Ethereum network updates and roadmap progress to evaluate technological risks and opportunities.

- Monitor regulatory developments globally, since legal clarity can either bolster confidence or inject volatility into ETH markets.

- Diversify portfolios to manage risks, keeping in mind that ETH’s volatility could result in sharp price swings.

- Use technical analysis and sentiment indicators alongside fundamental research to time entries and exits effectively.

Key Catalysts for Ethereum Price Growth

Several developments and market dynamics contribute to an optimistic Ethereum price prediction for 2025:

- Ethereum Network Upgrades: The upcoming Fusaka upgrade, scheduled for December 2025, is pivotal. It is expected to improve Ethereum’s scalability by increasing the block gas limit substantially and introducing new features like Peer Data Availability Sampling (PeerDAS). These improvements will enhance transaction speed and efficiency, attracting more users and institutional investors, and potentially driving the price beyond $5,000.

- Institutional Interest and ETF Inflows: The launch and growing popularity of spot Ethereum ETFs have attracted billions in institutional inflows. This increased participation from institutional investors brings liquidity and confidence to the market, further supporting Ethereum’s price growth.

- DeFi and Layer-2 Adoption: The expansion of DeFi applications and Layer-2 scaling solutions on Ethereum’s network means increased transaction volumes and fees, which translate into higher demand for ETH tokens for gas fees and staking, reinforcing the price surge thesis.

Conclusion: ETH Price Holds Promise Amid Uncertainty

Ethereum stands at a pivotal juncture. Its evolving technology and expanding ecosystem offer exciting potential for long-term price appreciation. However, the intrinsic volatility of cryptocurrencies and external challenges mean that the ETH price could swing sharply in either direction.

Investors and enthusiasts should keep abreast of ongoing developments and maintain a strategic approach to navigate this complex landscape. Whether bullish or bearish, the ethereum price prediction scenarios underscore that ETH remains a critical asset in the future of blockchain and decentralized finance.