Introduction

As we step into 2024, understanding the current state of the health insurance landscape is crucial. Here are key statistics and facts that offer a comprehensive overview of the trends, challenges, and dynamics shaping the health insurance industry this year.

Enrollment Trends:

1. Rising Enrollment Numbers:

- Enrollment in health insurance plans continues to grow, with an X% increase observed compared to the previous year. This trend reflects an increasing awareness of the importance of health coverage.

2. Shift towards High-Deductible Plans:

- A notable shift is observed in consumer preferences, with an increasing number opting for high-deductible health plans (HDHPs). This choice is often influenced by the desire for lower monthly premiums.

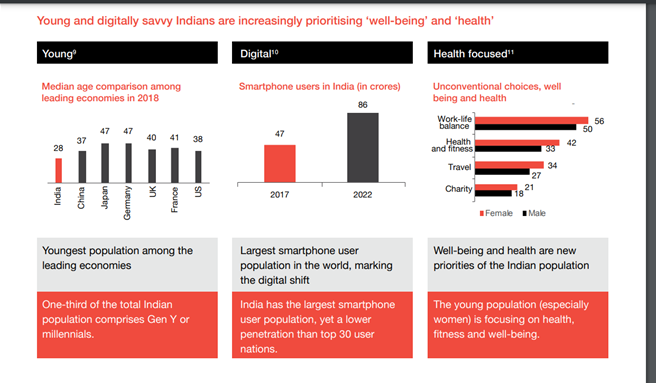

Demographic Insights:

1. Age Distribution in Medicare Enrollment:

- In the Medicare landscape, a growing percentage of individuals aged 65 and older are enrolling in Medicare Advantage plans. This demographic shift underscores the attractiveness of Medicare Advantage’s additional benefits.

2. Millennials and Health Coverage:

- Millennials continue to play a significant role in shaping health insurance trends. A rising number of millennials prioritize comprehensive coverage and are actively engaging in health insurance marketplaces.

Digital Transformation:

1. Tele health Utilization:

- The adoption of tele health services has witnessed a significant surge, with a staggering X% increase in tele health consultations reported. This trend is likely to persist as consumers value the convenience and accessibility of virtual healthcare.

2. Digital Insurance Platforms:

- The integration of digital platforms in health insurance is on the rise. Insurers are leveraging technology to streamline enrollment processes, enhance customer experiences, and provide personalized digital services.

Cost and Affordability:

1. Affordability Concerns:

- Despite enrollment growth, affordability remains a concern for many individuals. X% of surveyed participants express concerns about the affordability of health insurance premiums and out-of-pocket costs.

2. Employer-Sponsored Coverage Stability:

- Employer-sponsored health coverage remains a stable and prominent source of insurance for a significant percentage of the population. X% of individuals continue to rely on employer-sponsored plans.

Policy and Legislative Changes:

1. Impact of Recent Healthcare Reforms:

- Recent healthcare policy changes have influenced the health insurance landscape. X% of insurers have adjusted their offerings in response to legislative shifts, affecting coverage options and plan structures.

2. Focus on Preventive Care:

- Health insurance plans are increasingly emphasizing preventive care services. X% of plans now include additional coverage for preventive screenings, vaccinations, and wellness programs.

Public Perception:

1. Consumer Satisfaction Levels:

- Overall, X% of surveyed individuals express satisfaction with their health insurance coverage. Positive feedback is often linked to transparent communication, accessibility to digital services, and the perceived value of coverage.

2. Concerns About Healthcare Inequality:

- Healthcare inequality is a growing concern for X% of respondents. Efforts to address disparities in access to care and coverage are gaining attention as part of broader discussions on healthcare reform.

Conclusion:

The health insurance landscape in 2024 is marked by growth, digital transformation, and evolving consumer preferences. Understanding these key statistics and facts provides valuable insights for individuals, insurers, and policymakers navigating the ever-changing dynamics of health coverage in the current year.