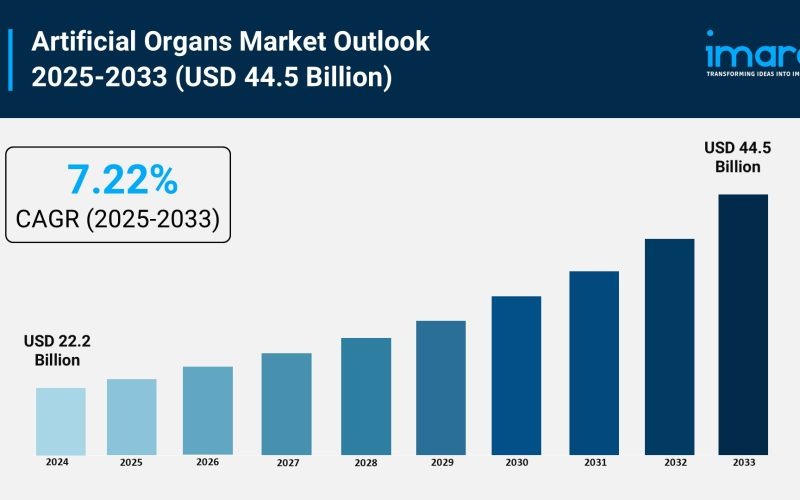

According to the latest research from IMARC Group, the global artificial organs market has reached an impressive USD 22.2 billion in 2024. Looking ahead, it’s projected to double in size, hitting USD 44.5 billion by 2033, with a steady growth rate of 7.22% from 2025 to 2033.

This report provides a thorough analysis of the market, covering industry size, current trends, market share, and significant growth factors. It compiles research findings, market assessments, and diverse data sources, along with key market dynamics such as challenges and opportunities.

You’ll also find insights into financial aspects, technological advancements, emerging trends, and innovations, as well as a regional market evaluation and competitive landscape.

How AI is Shaping the Future of the Artificial Organs Market

Artificial intelligence (AI) is revolutionizing the artificial organs market in remarkable ways.

- Precision in Organ Matching: AI enhances the accuracy of organ matching by analyzing patient-specific data, which can reduce the risk of rejection by about 15% through tailored assessments of donor-recipient compatibility.

- 3D Bioprinting Optimization: Machine learning algorithms are streamlining 3D bioprinting processes, leading to faster production of artificial kidneys and hearts. This technology improves accuracy in tissue structure replication by 20%.

- AI in Cardiac Care: Companies like BiVacor are implementing AI-powered control systems in artificial hearts to achieve real-time adjustments of cardiac output, mirroring natural heart functionality with 95% accuracy.

- Predictive Health Monitoring: AI-driven analytics can monitor post-implantation health effectively, detecting complications up to 48 hours earlier than traditional methods, thereby enhancing patient survival rates by 12%.

- Smart Biomaterials: Over 500,000 devices globally are utilizing AI sensors embedded in smart biomaterials to continuously monitor organ performance, providing real-time health data to medical teams.

Key Trends in the Artificial Organs Market

- 3D Bioprinting Advancements: The rise of bioprinting technologies is evident, with 30% more research institutions adopting advanced methods.

- Companies are creating patient-specific organs with complex vascular structures to reduce rejection rates. For instance, SynCardia Systems recently filed patents for a next-generation Total Artificial Heart.

- Surge in Wearable Artificial Organs: Innovations like portable dialysis machines and wearable kidneys are changing the game in patient care.

- For example, Vivance has successfully completed clinical trials for a wearable peritoneal dialysis device that enhances mobility for patients managing end-stage renal disease.

- Growing Demand for Artificial Kidneys: With 37 million Americans affected by chronic kidney disease and over 103,000 patients on transplant waiting lists, artificial kidney solutions are driving the market forward.

- Manufacturers are working on devices that can perform the full functionalities of a kidney while enhancing patients’ quality of life.

- Bionic Integration with Neural Systems: Electronic bionics with IoT features are setting new standards in patient monitoring. Cochlear Ltd. launched an implant compatible with 3.0 Tesla MRIs that addresses hearing issues with real-time data transmission.

- Government Funding for Innovation: BiVacor received $13 million from Australia’s Medical Research Future Fund in 2024 to develop the Total Artificial Heart. Additionally, the FDA is expediting approval processes for breakthrough devices, fast-tracking heart-assist and kidney products into the market.

Growth Factors in the Artificial Organs Market

- Donor Organ Shortages: In 2023, there were over 46,000 transplants, but more than 104,000 patients remain on waitlists in the US, with someone new added every 10 minutes.

- The long median wait time for kidney transplants, exceeding five years, underscores the urgent need for artificial alternatives.

- Epidemic of Chronic Diseases: The World Health Organization reported nearly 20 million new cancer diagnoses in 2022 alone, with many leading to organ failure. This trend drives demand for artificial solutions like hearts, kidneys, and livers.

- Adoption of Advanced Biomaterials: Silicon elastomers hold a significant 68% market share due to their biocompatibility, conductivity, and biodegradability—attributes that enable durable implants with lower rejection risks, supporting applications in minimally invasive surgeries and tissue engineering.

- Aging Population: By 2050, 16% of the global population will be over 65 years old. Europe alone may see its population aged 60 and older reach 300 million, increasing the prevalence of organ failures and boosting demand for artificial organs.

- Rapid FDA Approvals: In March 2022, Edwards Lifesciences received approval for the MITRIS RESILIA valve, aimed at the mitral heart position, which improves surgical outcomes.

- Furthermore, Medtronic gained approval in January 2024 for the MiniMed 780G System, enhancing diabetes management through continuous glucose monitoring.

This artificial organs market report provides a comprehensive overview essential for stakeholders navigating the complexities of the industry while capitalizing on emerging opportunities.

Leading Companies in the Global Artificial Organs Industry

- Abiomed, Inc.

- HeartWare International, Inc.

- Edwards Lifesciences Corp

- Boston Scientific Corporation

- Cochlear Limited

Market Segmentation

- By Type:

- Artificial Kidney

- Artificial Heart

- Artificial Pancreas

- Cochlear Implants

- Others

The artificial kidney segment holds the largest market share, driven by the increasing number of patients requiring renal replacement therapy and rising lifestyle-related diseases.

- By Region:

- North America (U.S., Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others)

- Europe (Germany, France, the UK, Italy, Spain, Russia, and others)

- Latin America (Brazil, Mexico, and others)

- Middle East and Africa

North America leads with over 45% market share in 2024, fueled by an increase in transplant surgeries, advanced healthcare infrastructure, and the presence of prominent biotechnology firms.

Recent Developments in the Artificial Organs Market

- January 2024: Medtronic announced the approval of the MiniMed 780G System, a groundbreaking tool for diabetes management focused on continuous glucose monitoring.

- February 2024: SynCardia Systems applied for patents for its next-generation Total Artificial Heart, enhancing biventricular support systems significantly.

- March 2024: Boston Scientific Corporation launched the Alaris bionic limb, an advanced prosthetic arm equipped with integrated sensors and AI-driven movement capabilities.

- April 2024: United Therapeutics Corporation successfully performed the world’s first transplant of the UThymoKidney, marking a significant milestone in artificial organ technology.

- October 2024: Cochlear Ltd. introduced the Smart Hearing Ecosystem in Europe, which integrates mobile devices with cochlear implants for improved remote monitoring.

If you have specific needs or require further details, feel free to reach out. We can tailor the information in this report to meet your requirements, ensuring you get the insights you need.

About Us

IMARC Group is a global management consulting firm dedicated to helping ambitious companies create lasting impacts. We offer a complete range of market entry and expansion services, including market assessments, feasibility studies, regulatory approvals, and strategic advice to support your goals.