Introduction

In the modern business landscape, efficiency and accuracy in financial processes are paramount. As companies strive to streamline their operations, the integration of e-invoicing, cloud technology, and digital workflows in outsourced accounts payable services has become increasingly vital. This blog post will explore how these technologies enhance outsourced accounts payable services, providing businesses with the tools they need to thrive in a competitive environment.

Understanding Outsourced Accounts Payable Services

Outsourced accounts payable services involve delegating the management of a company’s AP processes to a third-party provider. This can include tasks such as invoice processing, payment approvals, and vendor management. By outsourcing these functions, businesses can focus on their core operations while benefiting from the expertise and efficiency of specialized service providers.

Why Consider Outsourcing Accounts Payable?

- Cost Savings: Outsourcing can significantly reduce operational costs by eliminating the need for in-house staff and associated overhead expenses.

- Access to Expertise: Third-party providers often have specialized knowledge and experience in managing accounts payable processes, ensuring best practices are followed.

- Scalability: As businesses grow, their AP needs may change. Outsourcing allows for easy scalability, enabling firms to adjust their services based on demand.

The Role of E-invoicing in Outsourced AP Services

E-invoicing, or electronic invoicing, is the process of sending and receiving invoices in a digital format. This technology has transformed the way businesses manage their accounts payable processes. Here’s how e-invoicing enhances outsourced AP services:

1. Increased Efficiency

E-invoicing automates the invoice submission and approval process, reducing the time spent on manual data entry and paperwork. This leads to:

- Faster Processing Times: Invoices can be processed more quickly, allowing for timely payments to vendors.

- Reduced Errors: Automation minimizes the risk of human error, ensuring that invoices are accurate and complete.

2. Improved Visibility

With e-invoicing, businesses gain better visibility into their financial processes. This includes:

- Real-Time Tracking: Companies can track the status of invoices in real-time, providing insights into cash flow and outstanding payments.

- Enhanced Reporting: E-invoicing systems often come with reporting capabilities, allowing businesses to analyze their AP performance and identify areas for improvement.

3. Cost Reduction

By eliminating paper-based invoicing, businesses can reduce costs associated with printing, mailing, and storing physical invoices. Additionally, faster processing times can lead to early payment discounts from vendors, further enhancing cost savings.

The Impact of Cloud Technology on AP Services

Cloud technology has revolutionized the way businesses manage their financial processes, including accounts payable. Here are some key benefits of using cloud-based solutions in outsourced AP services:

1. Accessibility

Cloud-based AP solutions allow users to access financial data from anywhere, at any time. This flexibility is particularly beneficial for remote teams and organizations with multiple locations. Key advantages include:

- Collaboration: Teams can collaborate in real-time, ensuring that everyone has access to the latest information.

- Remote Work Support: Cloud technology enables employees to work from home or on the go, maintaining productivity regardless of location.

2. Enhanced Security

Security is a top concern for businesses when it comes to financial data. Cloud-based AP solutions often come with robust security measures, including:

- Data Encryption: Sensitive financial information is encrypted, protecting it from unauthorized access.

- Regular Backups: Cloud providers typically offer regular data backups, ensuring that information is safe and recoverable in case of a disaster.

3. Integration Capabilities

Cloud-based AP solutions can easily integrate with other financial systems, such as accounting software and enterprise resource planning (ERP) systems. This integration allows for:

- Streamlined Processes: Data can flow seamlessly between systems, reducing the need for manual data entry and improving overall efficiency.

- Comprehensive Reporting: Integrated systems provide a holistic view of financial performance, enabling better decision-making.

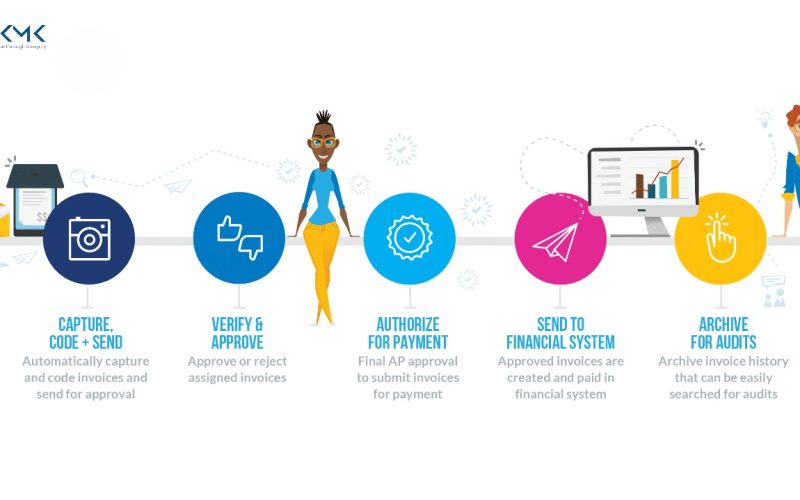

Digital Workflows: Streamlining AP Processes

Digital workflows are essential for optimizing accounts payable processes. By implementing digital workflows in outsourced AP services, businesses can achieve:

1. Automation of Approval Processes

Digital workflows automate the approval process for invoices, ensuring that payments are made promptly. This includes:

- Automated Notifications: Team members receive notifications when invoices require their approval, reducing delays in the payment process.

- Customizable Workflows: Businesses can tailor workflows to meet their specific needs, ensuring that the approval process aligns with their organizational structure.

2. Enhanced Compliance

Digital workflows help ensure compliance with internal policies and external regulations. This includes:

- Audit Trails: Digital workflows create a clear audit trail of all transactions, making it easier to track approvals and payments.

- Policy Enforcement: Automated workflows can enforce compliance with company policies, reducing the risk of fraud and errors.

3. Improved Vendor Relationships

By streamlining the AP process, businesses can enhance their relationships with vendors. This includes:

- Timely Payments: Faster processing times lead to timely payments, fostering goodwill and trust with suppliers.

- Clear Communication: Digital workflows facilitate better communication with vendors, ensuring that any issues are addressed promptly.

Why Businesses Choose Digital Outsourced AP Services

More companies are outsourcing AP because digital solutions provide better results than traditional internal processes.

- Cost Savings: Automation reduces the need for large AP teams, paper storage, printing, and mailing.

- Better Accuracy: Automated systems reduce human error and improve data quality.

- Faster Turnaround Times: Invoices are processed in minutes rather than days.

- Stronger Security: Cloud systems protect financial data with advanced security tools.

- Improved Vendor Relationships: Faster payments build trust with suppliers and prevent disputes.

- Clearer Financial Insights: Real-time dashboards allow businesses to track spending, payment cycles, and invoice statuses.

Key Features of a Modern Outsourced AP System

- Automated Data Capture: Invoices are read by the system using digital scanning or electronic formats. This reduces manual entry.

- Approval Routing: Invoices are automatically sent to the right person for review based on rules set by the company.

- Payment Scheduling: Businesses can choose when to pay invoices to manage cash flow better.

- Audit Trails: Every change, approval, and update is recorded to support compliance and transparency.

- Vendor Portals: Vendors can check invoice status themselves, reducing the number of support calls.

E-invoicing and Compliance

Businesses must follow various financial rules and tax requirements. E-invoicing makes this easier by creating clear digital records.

Digital invoices include accurate information that can be used for reporting, audits, and regulatory compliance. Outsourced AP teams often stay updated on industry standards, making it easier for businesses to meet their legal obligations.

How Cloud and Digital Tools Reduce Fraud

Fraud is a major concern in accounts payable, especially with manual processes. Digital workflows help prevent fraud by using automated checks and secure access controls.

Fraud prevention features:

- Multi-step verification

- Flagging duplicate or suspicious invoices

- Secure vendor validation

- User access controls

- Digital records that show every action taken

These tools protect companies from financial losses and help maintain trustworthy vendor relationships.

The Future of Outsourced AP Services

As technology continues to evolve, outsourced AP services will become even more advanced. Artificial intelligence, machine learning, and predictive analytics will allow faster decision-making and more accurate forecasting.

Future AP solutions may include:

- Predictive insights for spending trends

- Automated negotiation tools for vendors

- Smart payment scheduling based on cash flow

- Voice-activated approvals

- Fully touchless invoice processing

With these improvements, companies will enjoy even greater efficiency and accuracy.

Tips for Choosing the Right Outsourced AP Service Provider

- Look for automation capabilities: Choose a provider that offers e-invoicing, digital workflows, and cloud integration.

- Check their security standards: Make sure they use strong encryption and follow best practices for data protection.

- Ask about scalability: The system should handle large invoice volumes as your business grows.

- Compare support services: Good customer support ensures smooth communication and quick issue resolution.

- Review reporting and analytics: The provider should offer clear dashboards and reports for tracking AP performance.

Conclusion

The integration of e-invoicing, cloud technology, and digital workflows in outsourced accounts payable services is transforming the way businesses manage their financial processes. By leveraging these technologies, companies can achieve greater efficiency, accuracy, and cost savings in their accounts payable operations.

As businesses continue to navigate the complexities of financial management, embracing these innovations will be essential for staying competitive. If you’re interested in optimizing your accounts payable processes, consider exploring the benefits of outsourced accounts payable services. For more information, visit KMK Ventures.