Introduction

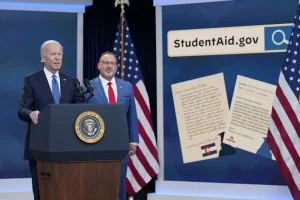

Us Debt Relief 2024: President Joe Biden is hoping to campaign on the issue of student debt cancellation this year. And the White House announced on Thursday a substantial extension of its plans in this regard.

The Biden administration’s draft proposal would give the Education Department the authority to cancel student loans for students. Who are having financial difficulties and are not expected to be able to pay back their debts.

The administration of President Joe Biden is moving to automatically erase student loan debt for Americans. Who are suffering hardship a category of borrowers that, according to officials, is broad but specifically designed to adhere to the decisions made by the Supreme Court.

US Debt Relief program

The agency suggested a one-time debt relief programmed that, based on data it has collected. They Would instantly eliminate debt in cases where debtors are at least 80% certain to default on their obligations during the next two years. The plan also takes into account applications from specific borrowers who are going through difficult times.

It lists over a dozen criteria, including household income total debt loan repayment history. And Pell award receipt, that the administration will consider when determining financial hardship. There were no set thresholds for those factors included in the proposal.

US Education Secretary M.R Miguel Cardona

Education Secretary Miguel Cardona unveiled the idea and declared. “We’ll leave no stone unturned in the fight to fix a broken student loan system.”

A federal rulemaking body will hold a public hearing on the idea on Thursday and Friday of next week. As previously announced, the Education Department intends to formally unveil the plans in May for public feedback.

US News Report about Debt Relief 2024

New Tonight the teacher loan forgiveness program in Michigan. Teacher struggling to pay their student loans as they work in the classroom could be able to get more help from a bill in Washington’s. It passed legislation introduced by Michigan senator. Debbie Stabenow would allow teacher to allow teachers to jointly apply for two federal loan forgiveness.

On News 8s David Horik said live from our Kalamazoo studio tonight to further breakdown this bill. He said Brian, first of, federal law prevents teachers from applying for both the teacher loan forgiveness program. And the public service loan forgiveness program at the same time. But if this bill, the teacher debt Relief Act, passes a chance to the higher education act of 1965 would allow that.

US Supreme Court Ruling: US Debt Relief 2024

Following the Supreme Court’s ruling last summer to overturn his initial attempt to cancel as much as $400 billion in outstanding debt. The most comprehensive portion of Biden’s Plan B method for clearing significant portions of student debt is included in the most recent edition.

A senior administration source told reporters on Thursday. He said “We are trying to figure out how to be as expansive as possible within the limits of the law and the court decision.” The official described the current approach as “quite broad and looking ahead.”

US Education Department’s plan: US Debt Relief 2024

The department’s plan makes reference to the probable legal actions. And that may result from Biden’s upcoming debt relief initiative. According to the draft proposal. “The costs of enforcing the full amount of the debt are not justified by the expected benefits of continued collection.

But the entire debt” in situations where borrowers are facing hardship and are unlikely to repay their debts. Following months of criticism from Congressional Democrats and student loan campaigners. Who were dissatisfied that a prior set of public hearings did not contain a broad category for students suffering hardship.

The Biden administration released its most recent draft. The administration has already stated that it is considering debt cancellation for specific groups of borrowers. And such as those whose interest-related liabilities have skyrocketed or those who attended underwhelming educational institutions.

Information regarding the number of borrowers who would be covered under the scheme was withheld by officials. All that was stated by an Education Department representative was that it would equate to a “meaningful number of borrowers.”