In a groundbreaking development, the integration of artificial intelligence (AI) into financial markets has ushered in a new era of efficiency and innovation. With machine learning algorithms and advanced data analytics at their disposal, AI-driven platforms are transforming the landscape of trading, investment, and risk management. Financial institutions worldwide are embracing this disruptive technology, sparking significant advancements in decision-making, automation, and market predictions.

Feature Story: How AI is Disrupting Financial Markets: A Paradigm Shift

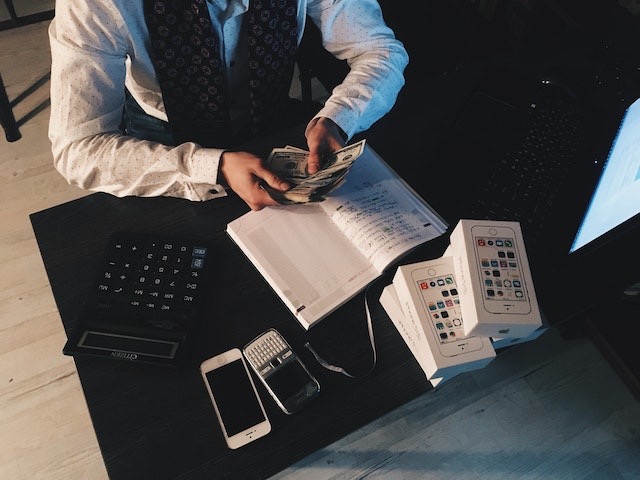

Artificial intelligence is making a profound impact on financial markets, redefining how professionals trade and invest. Gone are the days of relying solely on human intuition and experience; AI has become an indispensable tool for financial decision-makers.

One of the primary advantages of AI in finance is its ability to process vast amounts of data at lightning speed. Machine learning algorithms analyze historical market patterns, news sentiment, and even social media trends, enabling investors to make data-driven decisions with higher precision. AI systems are adept at identifying profitable trading opportunities and mitigating risks by evaluating market volatility and correlation in real-time.

Automated trading algorithms, known as robo-advisors, have gained popularity among retail investors. These AI-powered platforms offer personalized investment strategies based on individual risk profiles, financial goals, and market trends. By democratizing access to sophisticated financial advice, robo-advisors are revolutionizing retail investing and empowering individuals to build wealth more effectively.

AI has also proven instrumental in fraud detection and risk management. Advanced algorithms can sift through vast datasets to identify anomalies, detect insider trading, and flag potential market manipulation. By enhancing compliance efforts, AI technology promotes transparency and trust within the financial system.

Opinion Piece: AI in Financial Markets: A Double-Edged Sword

Artificial intelligence has undoubtedly brought numerous benefits to financial markets, but it also poses unique challenges and risks. While algorithms can process vast amounts of data, they are not immune to biases or unforeseen circumstances. The reliance on historical data patterns may overlook novel events, making AI systems vulnerable during black swan events or periods of market turbulence.

There are also concerns about the ethical implications of AI in finance. High-frequency trading, driven by AI algorithms, raises questions about market fairness and the potential for excessive volatility. Critics argue that the lack of human intervention may exacerbate market downturns, leading to unpredictable consequences.

Moreover, the growing dominance of AI-driven hedge funds and algorithmic trading strategies can lead to a concentration of power among a few technology giants. This concentration may pose systemic risks if an unforeseen event triggers a widespread response from interconnected algorithms.

Verifying Information and Uncovering Sources: When reporting on the impact of AI on financial markets, it is crucial to ensure accurate and reliable information. Here are some research techniques to follow:

- Consult reputable academic sources, financial institutions, and industry reports.

- Conduct interviews with experts in the fields of finance, AI, and regulatory bodies overseeing the financial markets.

- Analyze case studies and real-world examples to provide concrete evidence of AI’s impact.

- Monitor industry conferences and research papers to stay updated on the latest advancements.

- Collaborate with data scientists and researchers specializing in AI applications in finance.

Adhering to Journalistic Ethics: As a journalist, it is essential to uphold ethical standards while reporting on the impact of AI on financial markets. Respect the following principles:

- Accuracy: Verify facts, sources, and data to ensure the information provided is correct.

- Objectivity: Present a balanced view, considering different perspectives and avoiding personal bias.

- Transparency: Clearly identify sources, potential conflicts of interest, and any limitations in the research.