PayPal vs. Payoneer: A Comprehensive Comparison

In today’s fast-paced world, choosing the right online payment platform can make a significant difference in your financial transactions. Two prominent players in this space, PayPal vs. Payoneer, offer a wide range of services. But which one is the superior choice? In this article, we’ll delve into the key factors that matter most to users, including security, uses and integrations, fees, payment limits, and withdrawal times. By the end, you’ll have a clear understanding of which platform aligns with your specific needs.

PayPal vs. Payoneer: Which Is More Secure?

PayPal Security Page

When it comes to the security of your financial transactions, both PayPal and Payoneer take it seriously. PayPal’s security center provides detailed insights into their security protocols. They offer features such as the PayPal security key, fraud monitoring, data encryption, and email payment confirmation. These security measures can be enhanced for businesses at an additional cost. PayPal also proudly displays its security certifications, leaving no doubt about its commitment to safety.

Payoneer’s Robust Security

Payoneer’s security page showcases a list of reputable brands and services that trust Payoneer. It also highlights Payoneer’s licenses and security certifications from regulatory bodies worldwide. In terms of user-side security, Payoneer offers two-step verification, RSA authentication, and account takeover prevention. Both platforms demonstrate a strong commitment to protecting your financial data.

PayPal vs. Payoneer: Uses and Integrations

Payoneer’s Versatility

Payoneer shines when it comes to integrations. It’s seamlessly integrated with platforms like Fiverr, Upwork, and iStock, making it a preferred choice for freelancers and businesses. You can easily bill clients and handle payments in multiple currencies. Payoneer also supports online shopping and works smoothly with major retailers like Amazon, Walmart, and Alibaba.

PayPal’s Extensive Reach

PayPal, with its extensive history in online transactions, offers a broad range of uses and integrations. It’s accepted on thousands of platforms, including Amazon, Wish, Fiverr, and Airbnb. Beyond traditional payments, PayPal provides services such as bill management, business loans, savings goals, and access to valuable business resources. Its long-standing presence in the industry has allowed it to refine its offerings extensively.

PayPal and Payoneer’s Accepted Payment Methods

PayPal’s Payment Options

PayPal offers various payment methods, including credit and debit card linkage, facilitating credit card rewards, and even crypto transactions. You can easily fund your PayPal account with your card, making it a convenient choice for users.

Payoneer’s Approach

Payoneer, on the other hand, has a different approach. You cannot add money to your Payoneer account from your bank, but you can receive funds from marketplaces and clients. Payoneer also supports multiple currencies, allowing for seamless currency conversion. While funds in your Payoneer account are accessible via debit card transactions, it’s essential to understand the process of obtaining and using the Payoneer debit card.

In terms of payment convenience, PayPal has the edge, as it allows direct funding through credit and debit cards.

PayPal vs. Payoneer: Fees

PayPal’s Fee Structure

Both PayPal and Payoneer offer valuable services, but they have different fee structures. PayPal’s fees vary depending on the type of transaction and your region. While personal transactions within the same currency are often free, merchant fees can range from 1.9% to 3.49%, with additional fixed fees for some transactions. PayPal also charges fees for buying and selling cryptocurrencies, with rates varying based on transaction amounts.

Payoneer’s Fee Clarity

Payoneer’s fee structure is more straightforward. Transactions between Payoneer accounts are typically free, irrespective of the currency. However, Payoneer charges up to 3% of the transaction value when users request payments from their clients via the platform. Moreover, integration with marketplaces like Fiverr and Upwork comes with varying transaction fees, which can be checked on their respective websites.

In terms of fee transparency and simplicity, Payoneer emerges as the easier platform to work with.

Payment Limits on PayPal and Payoneer

PayPal’s Transaction Limits

PayPal allows first-time users a one-time transaction limit of up to $4,000 without creating an account. Verified PayPal account holders can send unlimited money, but individual transactions may have a limit of $10,000.

Payoneer’s Transaction Limits

Payoneer permits daily transactions of up to $25,000 and monthly sending and receiving limits of $50,000 and $100,000, respectively. While PayPal has a higher one-time transaction limit for unverified users, Payoneer offers more flexibility in bulk transactions.

PayPal vs. Payoneer: Withdrawal Times

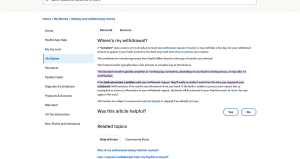

PayPal’s Withdrawal Options

PayPal provides two withdrawal options: Instant Withdrawal and Standard Withdrawal. Instant Withdrawal typically takes one to 30 minutes, while Standard Withdrawal may take a full working day. These times depend on your bank’s processing speed.

Payoneer’s Withdrawal Timeframe

Payoneer maintains a standard withdrawal time of one day for all users, which could extend to two business days in some cases.

PayPal vs. Payoneer: Our Verdict

Considering all the factors discussed, the choice between PayPal and Payoneer depends on your specific needs. PayPal’s extensive support and limitless transactions make it an excellent choice for personal and general business use. In contrast, Payoneer excels at facilitating payment requests from clients and businesses. The decision ultimately boils down to how you intend to use these platforms.

In the world of online payments, both PayPal and Payoneer offer reliable solutions, ensuring that your financial transactions are secure and convenient.

Key Comparison Table

| Aspect | PayPal | Payoneer |

|---|---|---|

| Security | Robust security protocols | Strong security measures |

| Uses and Integrations | Extensive reach and services | Versatile integrations |

| Accepted Payment Methods | Credit/debit card, crypto support | Marketplaces and client payments |

| Fees | Complex fee structure | Transparent fee structure |

| Payment Limits | High one-time limit for unverified | Flexible sending and receiving |

| Withdrawal Times | Instant and standard options | Standard one-day withdrawal |

In this comprehensive comparison, we’ve explored the key aspects of PayPal and Payoneer, helping you make an informed decision based on your unique needs and preferences. Both platforms offer valuable services, but understanding their differences is crucial to selecting the right one for your financial transactions.