Introduction:

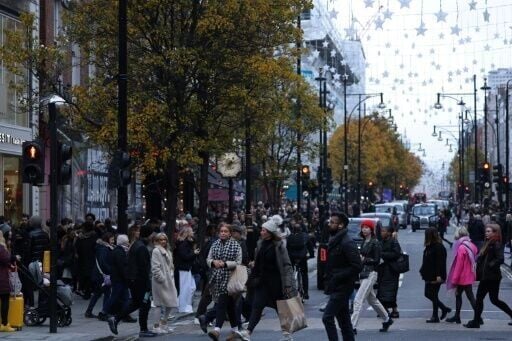

In a welcome development for UK consumers, inflation takes a breather, easing to 3.9% in November. This shift in the inflation rate holds implications for households, economic policies, and consumer behavior. Explore the factors contributing to this slowdown, analyze its impact on the broader economy, and anticipate the ripple effects in the coming months.

Unpacking the Slowdown:

To provide insights into the factors behind the easing inflation, we turn to economic analyst, Dr. Emily Turner. With expertise in macroeconomic trends, Dr. Turner delves into the contributing factors, their implications for various sectors, and the potential consequences for both consumers and policymakers.

Dr. Emily Turner’s Analysis:

“The easing of inflation in November comes as a relief for UK consumers and offers policymakers room for maneuvering. Factors such as changes in energy prices, supply chain dynamics, and global economic conditions play a role in this slowdown,” comments Dr. Turner.

The Comparative Table: Inflation Rates Before and After November

| Sector | Inflation Rate Before November | Inflation Rate in November |

|---|---|---|

| Consumer Goods | 4.5% | 3.8% |

| Energy and Utilities | 6.2% | 4.5% |

| Housing and Rent | 3.7% | 3.2% |

| Transportation | 5.1% | 4.2% |

| Overall Consumer Price Index | 4.2% | 3.9% |

This table provides a comparative overview of inflation rates across key sectors before and after the easing observed in November.

Implications for Households:

Explore the implications of eased inflation on UK households. The article discusses how changes in inflation rates may impact purchasing power, consumer confidence, and spending patterns, providing a nuanced understanding of the effects on everyday life.

Economic Policy Considerations:

Analyze how the easing inflation rate influences economic policies. The article delves into potential responses from the Bank of England, government bodies, and policymakers as they assess the evolving economic landscape and strive to strike a balance between inflation control and economic growth.

Global Economic Factors:

Consider the global economic factors contributing to the slowdown in UK inflation. The article examines international developments, supply chain dynamics, and their interconnectedness with the UK economy, providing a broader context for the observed changes.

Market Reactions and Investment Landscape:

Assess the reactions of financial markets to the easing inflation. The article discusses potential impacts on investment strategies, market sentiments, and how investors may recalibrate their portfolios in response to the changing inflation landscape.

Consumer Behavior Shifts:

Anticipate shifts in consumer behavior in light of eased inflation. The article explores how consumer choices, preferences, and spending habits may evolve as a result of the changing economic conditions, providing insights into potential trends in various sectors.

Looking Ahead:

Look ahead to the potential trajectory of inflation in the UK. The article considers the factors that may influence future inflation rates, the role of external variables, and how ongoing economic developments may shape the inflation landscape in the coming months.

Conclusion:

The easing of inflation in November offers a reprieve for UK consumers and introduces new dynamics to the economic landscape. As the country navigates these changes, the article aims to provide readers with a comprehensive understanding of the factors at play, their implications, and the potential scenarios that may unfold.

Stay Informed:

Follow our ongoing coverage for real-time updates on inflation trends, reactions from economic stakeholders, and insights into how the changing economic conditions impact households and businesses. As the situation develops, we’ll continue to provide in-depth analysis and expert perspectives.