Introduction

In today’s highly competitive and fast-paced market, businesses are under increasing pressure to be more efficient, reduce overheads, and stay financially agile. One often overlooked area where companies can unlock significant value is accounts payable (AP).

Traditionally handled in-house, AP is now one of the most commonly outsourced financial functions. As we step deeper into 2025, many companies are reevaluating their finance departments and asking a key question:

Is accounts payable outsourcing the smartest move for your business in 2025?

Let’s break it down and explore why more businesses from startups to established enterprises are making the shift.

Benefits of Outsourcing Accounts Payable

Outsourcing your AP brings clear advantages. First, you cut labor costs by paying only for the volume of invoices processed, rather than maintaining a full team year-round. Second, providers use automation tools that speed up data capture, reduce manual errors, and ensure faster payments to suppliers. Third, you free up your finance staff to focus on analysis and strategic work instead of chasing approvals or correcting mistakes. Finally, many outsourcing firms offer deep reporting insights, giving you real-time visibility into cash flow and spending patterns without extra setup.

Role of AP Outsourcing in Your Finance Function

AP outsourcing serves as an extension of your finance department. The provider takes over routine tasks—like invoice receipt, data entry, three-way matching, and payment execution—while following your policies and controls. They integrate with your ERP system to keep data synchronized, so your ledgers stay up to date. You manage exceptions and approvals through a shared portal, ensuring no loss of oversight. In this way, outsourcing becomes the engine that handles day-to-day transaction work, letting your in-house team focus on higher-value activities like budgeting and vendor negotiations.

How Accounts Payable Outsourcing the Smartest Move for Your Business?

1. The Evolving Role of Accounts Payable

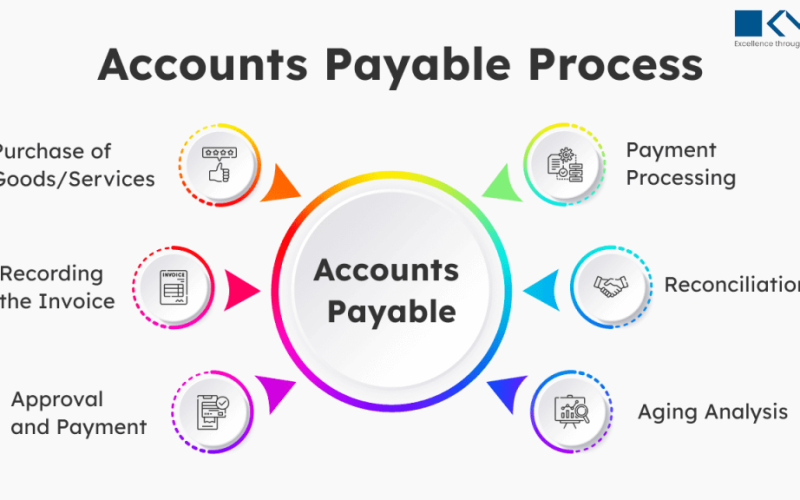

Accounts payable is no longer just about paying bills. It’s about managing vendor relationships, optimizing cash flow, complying with regulations, and ensuring transparency across all financial operations. With growing invoice volumes and increasingly complex compliance requirements, handling AP manually or in-house can quickly become inefficient.

Outsourcing AP functions enables companies to offload time-consuming tasks like invoice processing, vendor communication, and payment tracking all while gaining accuracy, speed, and financial clarity.

2. Cost Savings Without Compromise

One of the most immediate benefits of outsourcing accounts payable is significant cost reduction. Maintaining an in-house AP team involves salaries, training, benefits, software licenses, and workspace expenses. As businesses grow, these costs only increase.

By outsourcing, companies eliminate many of these overheads. Outsourced providers work at scale and often operate from regions with lower labor costs translating into savings of up to 40–60% on AP processing.

Even better? These savings come without compromising quality. In fact, many outsourced AP teams bring higher accuracy and better technology to the table.

3. Access to Modern Tools and Automation

In 2025, automation is not optional it’s essential. AP outsourcing firms leverage powerful accounting platforms like QuickBooks, Xero, SAP, NetSuite, and FreshBooks, combined with automation tools such as Dext, Bill.com, and Tipalti.

These systems streamline the entire accounts payable process:

- Capture and digitize invoices automatically

- Match invoices with purchase orders

- Route them for approval

- Schedule timely payments

- Maintain detailed audit trails

The result? Faster processing, reduced human error, and real-time visibility into your payables.

4. Scalability to Match Business Growth

As your business scales, the number of invoices, vendors, and payment deadlines grows, too. Managing all this in-house means hiring more staff, investing in more infrastructure, and dealing with growing pains.

Outsourcing eliminates this problem.

A good AP outsourcing partner can scale up or down effortlessly based on your needs. Whether you’re expanding into new markets or going through seasonal fluctuations, they offer flexibility without the operational stress.

This agility makes outsourcing a perfect match for growing businesses.

5. Accuracy, Control, and Reduced Risk

Errors in accounts payable — like duplicate payments, missed due dates, or incorrect data entries — can have serious consequences. These mistakes can hurt vendor relationships, lead to financial loss, or even create audit risks.

Outsourced AP providers have strict internal controls and validation processes in place to minimize these risks. They use automated 2-way or 3-way matching systems, multi-level approvals, and real-time monitoring tools to ensure every transaction is accurate and traceable.

With regular reconciliations and compliance checks, you gain peace of mind knowing your AP process is running smoothly and securely.

6. Stronger Vendor Relationships

Your suppliers are essential to your success and they expect timely, accurate payments. Late payments can damage trust, delay projects, and affect your business’s reputation.

Outsourced AP providers focus on consistency and professionalism. They ensure invoices are processed quickly, payments are made on time, and any issues are resolved promptly. Some even offer vendor portals where suppliers can check payment status or submit queries directly.

This smooth experience leads to better vendor relationships, more favorable terms, and enhanced loyalty.

7. Better Compliance and Audit Preparedness

Financial compliance is a growing concern for businesses across industries. From tax regulations to audit readiness, the requirements are getting stricter and mistakes can be costly.

Outsourced providers stay updated on the latest legal, tax, and financial compliance standards. They follow best practices and offer detailed reporting, secure documentation, and audit trails all of which support regulatory compliance.

Many also adhere to international data protection standards such as SOC 2, ISO 27001, and GDPR, making them reliable partners in both compliance and cybersecurity.

8. Real-Time Reporting and Decision-Making Power

Modern AP outsourcing firms provide clients with real-time dashboards and reporting tools. You can track pending invoices, payments due, and cash flow status anytime, anywhere.

These insights allow you to:

-

Make faster, data-driven decisions

-

Manage working capital more efficiently

-

Plan ahead for seasonal or unexpected expenses

-

Reduce the risk of cash shortages or payment delays

In 2025, access to real-time financial data is no longer a luxury — it’s a competitive advantage.

9. Letting Your Team Focus on What Matters

Perhaps the biggest reason companies outsource accounts payable is this: focus.

When you remove the burden of invoice entry, payment tracking, and vendor follow-ups from your internal team, you give them time and space to focus on strategy, growth, and high-value work.

Your CFO can analyze trends and improve forecasting. Your finance team can support long-term planning. And your business can thrive — without being bogged down by day-to-day AP tasks.

Conclusion

Outsourcing accounts payable can be one of the smartest moves your business makes—if done right. You’ve seen how AP outsourcing benefits include cost savings, improved accuracy, faster processing, and better vendor relationships. Addressing concerns around security, control, and integration ensures a smooth transition. Choosing the right provider and following best practices—clear communication, standardized workflows, and performance monitoring—maximizes your success. Whether your goal is to cut expenses, scale flexibly, or refocus staff on strategic tasks, accounts payable outsourcing offers a proven path to greater efficiency and growth. Consider a pilot program today, and watch your finance function transform into a competitive advantage.

Final Thoughts

So, is accounts payable outsourcing the smartest move for your business in 2025?

Absolutely if you want to save time, reduce costs, eliminate errors, and scale with confidence.

Whether you’re a startup with limited resources or a growing enterprise ready to streamline finance, AP outsourcing delivers the tools, expertise, and flexibility needed to thrive in today’s market.

In a world that rewards speed, precision, and agility outsourcing accounts payable isn’t just smart. It’s strategic.