Managing payroll is a critical yet complex task for small businesses. It involves more than just issuing paychecks; it encompasses calculating wages, withholding taxes, ensuring compliance with labor laws, and maintaining accurate records. As businesses grow, these tasks can become increasingly burdensome, leading many small business owners to consider outsourcing their payroll functions. This comprehensive guide explores the benefits, processes, and considerations of outsourcing small business payroll services.

Understanding Payroll Services for Small Businesses

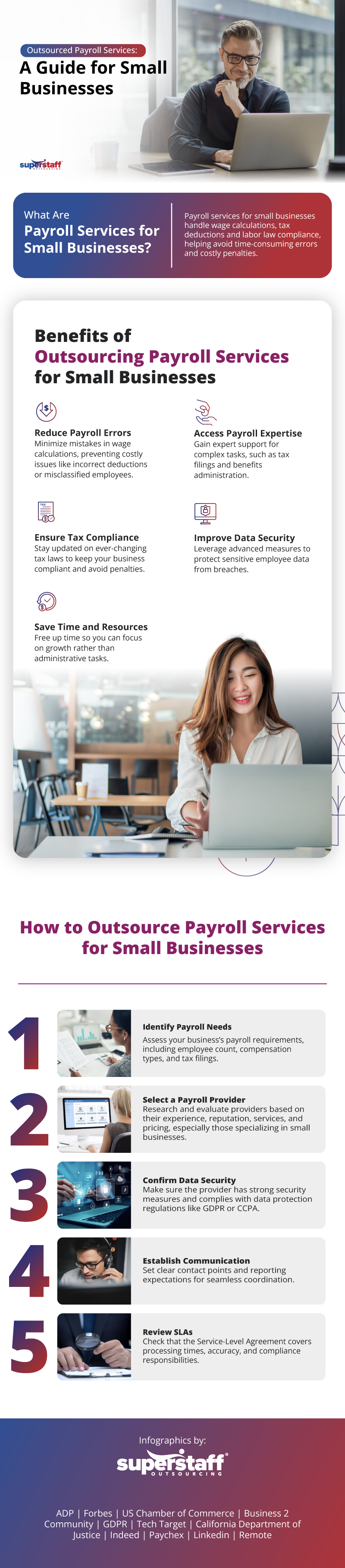

Payroll services for small businesses involve handling various tasks, including wage calculations, tax deductions, compliance with labor laws, and employee benefits management. These services utilize advanced technologies, such as automation and artificial intelligence, to streamline processes like tax filings and direct deposits, ensuring employees are paid accurately and on time. Managing payroll in-house can be challenging, especially with manual processes that are prone to errors and compliance risks. Payroll mistakes can lead to costly penalties and damage employee trust.

The Challenges of In-House Payroll Management

Handling payroll internally presents several challenges for small businesses:

-

Time-Consuming Processes: Calculating wages, processing payments, and ensuring compliance require significant time and attention to detail.

-

Compliance Risks: Tax laws and labor regulations are constantly evolving. Staying updated and compliant can be difficult without dedicated expertise.

-

Risk of Errors: Manual payroll processing increases the likelihood of mistakes, which can lead to financial penalties and employee dissatisfaction.

-

Resource Allocation: Small businesses may lack the resources to maintain an in-house payroll department, leading to overburdened staff and potential burnout.

Benefits of Outsourcing Payroll Services

Outsourcing payroll functions can offer numerous advantages to small businesses:

-

Cost Savings: Outsourcing can be more cost-effective than hiring and training in-house staff. It reduces expenses related to salaries, benefits, and ongoing training required to keep up with changing regulations.

-

Time Efficiency: Delegating payroll tasks to external experts frees up valuable time for business owners and employees, allowing them to focus on core business activities and strategic growth initiatives.

-

Enhanced Compliance: Payroll service providers specialize in staying current with tax laws and labor regulations, reducing the risk of non-compliance and associated penalties.

-

Improved Accuracy: Professional payroll providers utilize advanced systems to ensure precise calculations and timely payments, minimizing errors that could lead to financial discrepancies or employee dissatisfaction.

-

Access to Advanced Technology: Outsourcing grants small businesses access to cutting-edge payroll software and technologies that might be too costly to implement in-house, enhancing overall efficiency and employee satisfaction.

-

Data Security: Reputable payroll providers implement robust security measures to protect sensitive employee information, reducing the risk of data breaches and ensuring confidentiality.

When to Consider Outsourcing Payroll

Small businesses should evaluate their current payroll processes and consider outsourcing if they experience:

-

Frequent Payroll Errors: Regular mistakes in payroll processing can lead to employee dissatisfaction and potential legal issues.

-

Compliance Challenges: Difficulty keeping up with changing tax laws and labor regulations can increase the risk of non-compliance.

-

Resource Constraints: Limited staff and resources dedicated to payroll can result in overworked employees and decreased productivity.

-

Desire for Scalability: As the business grows, managing payroll internally can become more complex. Outsourcing allows for scalable solutions that adapt to the company’s needs.

How to Outsource Payroll Services

Transitioning to an outsourced payroll solution involves several key steps:Q

-

Assess Your Payroll Needs: Evaluate the specific requirements of your business, including the number of employees, pay frequency, and any unique payroll considerations.

-

Research Potential Providers: Look for payroll service providers with experience in your industry, a strong reputation, and the ability to meet your specific needs.

-

Evaluate Services Offered: Ensure the provider offers comprehensive services, including tax filing, compliance management, direct deposit, and employee self-service options.

-

Consider Technology and Integration: Choose a provider that utilizes advanced technology and can integrate seamlessly with your existing systems, such as accounting software.

-

Review Security Measures: Confirm that the provider has robust data security protocols to protect sensitive employee information.

-

Understand Pricing Structure: Clarify the provider’s pricing model, including any additional fees for extra services, to ensure it aligns with your budget.

-

Check Compliance Support: Ensure the provider stays updated with tax laws and labor regulations and offers support to maintain compliance.

-

Request References: Ask for client references or case studies to gauge the provider’s reliability and customer satisfaction.

Potential Drawbacks of Outsourcing Payroll

While outsourcing payroll offers numerous benefits, it’s essential to consider potential drawbacks:

- Loss of Control: Entrusting payroll to an external provider means relinquishing some control over the process. It’s crucial to choose a trustworthy provider and establish clear communication channels.

-

Integration Challenges: Ensuring that the provider’s systems integrate smoothly with your existing software can be complex and may require additional resources.

-

Dependence on Provider’s Reliability: Your business relies on the provider’s accuracy and timeliness. Any failures on their part can impact your operations and employee satisfaction.

Conclusion

Outsourcing payroll services can be a strategic move for small businesses seeking to streamline operations, ensure compliance, and focus on core business functions. By carefully selecting a reputable provider and clearly defining your payroll needs, you can leverage the benefits of professional payroll management to support your business’s growth and success.