Introduction

Welcome to the world of John Doe, a seasoned insurance advisor with over a decade of experience in the field. John has spent years guiding renters through the maze of insurance decisions, with a particular focus on the often-overlooked area of earthquake insurance.

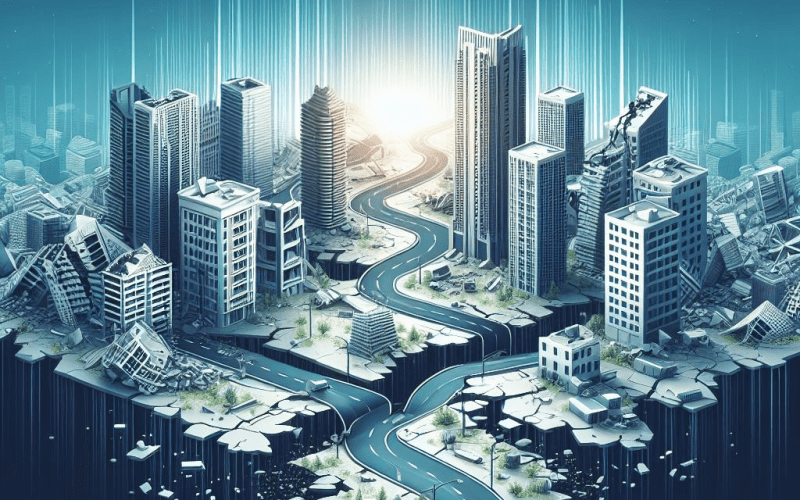

Demystifying Earthquake Insurance

Earthquake insurance is a specialized form of coverage that steps in to protect your personal property from the devastating effects of an earthquake. While homeowners are often aware of this coverage, many renters underestimate its importance.

The Case for Earthquake Insurance for Renters

As a renter, you may not own the building you live in, but you certainly own valuable items within your rented space. From electronics to furniture to personal belongings, these items could be at risk if an earthquake strikes. Earthquake insurance can cover the cost of replacing these items, providing a safety net when you need it most.

The Perils of Going Uninsured

Without earthquake insurance, you could find yourself facing significant out-of-pocket expenses to replace damaged belongings. Moreover, if your rental unit becomes uninhabitable due to earthquake damage, you could also be on the hook for additional living expenses. These costs can quickly add up, making earthquake insurance a wise investment.

Weighing the Cost of Earthquake Insurance

The cost of earthquake insurance can vary widely based on several factors. These include the location of your rental unit, the value of your personal belongings, and the specifics of the policy itself. It’s crucial to get a quote and weigh this cost against the potential risk.

Making an Informed Decision

The decision to purchase earthquake insurance is a deeply personal one. It requires a clear understanding of the risks involved and a careful evaluation of your financial situation. By arming yourself with knowledge, you can make a decision that aligns with your needs and gives you peace of mind.

Conclusion

While earthquake insurance may not be a legal requirement for renters, it’s an option that deserves serious consideration. By understanding the potential risks and benefits, you can make an informed decision that best suits your needs and circumstances.

Table: Key Points to Consider

| Consideration | Description |

|---|---|

| Coverage | Earthquake insurance covers personal property damage and additional living expenses. |

| Risk | Without coverage, you could face significant out-of-pocket expenses. |

| Cost | The cost of insurance varies based on location and personal property value. |

| Decision | The choice to purchase insurance should be based on an understanding of the risks and your financial situation. |

Remember, the right insurance coverage can offer peace of mind. If you live in an area prone to earthquakes, it’s worth considering earthquake insurance as part of your rental strategy