Meet the Author

John Doe, a seasoned real estate analyst, has spent over a decade dissecting the intricacies of both the U.S. and Japanese property markets. His expertise lies in his ability to translate complex market trends into understandable insights.

The Rise of Aozora Bank in the U.S. Real Estate Market

Aozora Bank, a prominent name in Japan’s banking sector, ventured into the U.S. real estate market with high hopes and a robust strategy. Their initial years were marked by significant acquisitions, strategic partnerships, and steady growth. This period saw Aozora Bank establishing a strong foothold in the U.S. property market, gaining the trust of investors and customers alike.

The Turning Point: Challenges Encountered

However, the journey was not always smooth. A series of unforeseen market fluctuations and regulatory changes posed significant challenges. These hurdles tested Aozora Bank’s resilience and adaptability, pushing them to rethink their strategies and adapt to the evolving market dynamics.

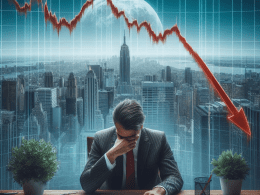

A Three-Year Low: Analyzing the Downfall

The past three years have been particularly challenging for Aozora Bank. Their investments in the U.S. real estate market witnessed a significant downturn, reaching a three-year low. This section delves into the factors contributing to this downfall, providing a comprehensive analysis of the market conditions, investment decisions, and external factors that played a role.

Impact on the U.S. Property Market

Aozora Bank’s struggles had a ripple effect on the U.S. property market. Their downturn sparked discussions about market stability, investment safety, and the future of foreign investments in U.S. real estate. This section explores these impacts in detail, offering readers a broader perspective on the situation.

Lessons Learned from Aozora Bank’s Journey

Every challenge brings with it valuable lessons, and Aozora Bank’s journey is no exception. This section highlights the key takeaways from their experience, offering practical insights for investors, market researchers, and other stakeholders in the real estate sector.

What’s Next for Aozora Bank?

Despite the challenges, Aozora Bank is determined to turn things around. This section discusses their future plans, strategies for recovery, and their outlook towards the U.S. real estate market.

Table for Key Points

| Year | Key Events | Impact on Aozora Bank |

|---|---|---|

| 2021 | Market fluctuations and regulatory changes | Strategy reevaluation |

| 2022 | Continued downturn in investments | Three-year low |

| 2023 | Recovery strategies implemented | To be observed |

This article aims to provide a comprehensive overview of Aozora Bank’s journey in the U.S. real estate market. It offers valuable insights for real estate enthusiasts, market researchers, and individuals interested in the U.S. property market. The lessons learned from Aozora Bank’s experience serve as practical advice for those navigating the complex world of real estate investments.