Executive Summary

The petrochemicals market is the backbone of modern manufacturing and goods, turning oil and natural gas into critical chemicals and polymers. Valued at approximately USD 659 billion in 2024, it’s projected to reach USD 1.19–1.34 trillion by 2034, with a steady CAGR of 6–8% Asia-Pacific leads this expansion, accounting for over 50% of global production in 2024 . Ethylene and propylene dominate feedstock volumes, while polymers—especially for packaging—account for the largest application share.

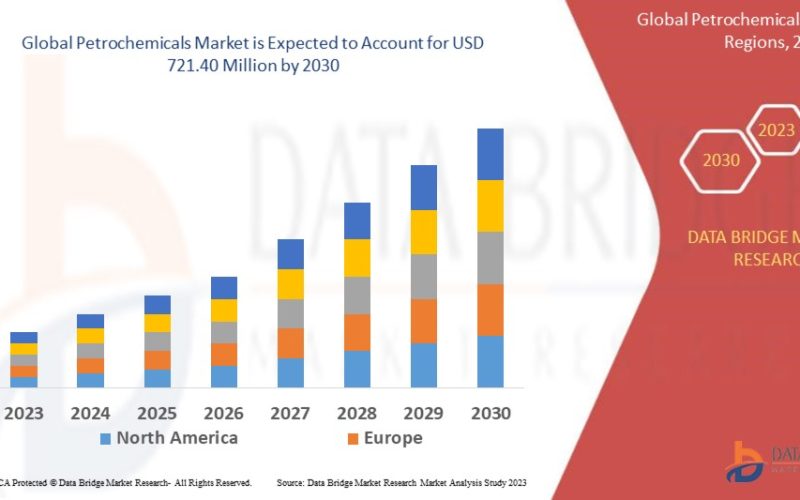

The global petrochemicals market size was valued at USD 453.69 million in 2023 and is projected to reach USD 770.82 million by 2031, with a CAGR of 6.85% during the forecast period of 2024 to 2031. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

One significant trend driving growth in the petrochemicals market is the increasing demand for sustainable products. As consumers and industries prioritize sustainability, there is a shift towards bio-based and recyclable petrochemical products. For instance, In November

Introduction to Petrochemicals

Key End-Products

- Polymers & Plastics: Polyethylene, polypropylene, PVC for containers, films, pipes.

- Synthetic Rubber: Butadiene-based, used in tires and seals.

- Solvents & Coatings: For paints, adhesives, and chemical synthesis.

- Fuels & Intermediates: Methanol, xylene, toluene used in fuel additives and industrial processing

Market Overview & Forecast

Market Size & Growth Rate

- 2024: USD 659 billion – 700 billion

- 2034 Forecast: USD 1.19–1.34 trillion (CAGR ~6–8%)

- Mid-range forecasts predict USD 620 billion (2024) → USD 1.04 trillion by 2034 (5.3% CAGR)

- Insight Partners projects USD 457 billion (2023) → USD 685 billion by 2031 (5.2% CAGR)

Regional Insights

- Asia-Pacific: Largest market at ~52–53% share; rapid industrialization and rising consumption drive expansion

- North America: Stable growth (5–6% CAGR), supported by innovation and shale-backed feedstock .

- Europe: Moderate growth (4.6–6.85%) with focus on sustainability .

- Latin America & Middle East/Africa: Emerging markets with increasing investments .

Segmentation Analysis

By Product Type

- Ethylene: ~40–43% share; backbone of plastic production Methanol: High-growth segment (~7.9% CAGR) used in chemicals, fuels

- Propylene, Benzene, Butadiene, Xylene/Toluene, with varied industrial roles

By Application

- Polymers: Largest application (~43% share) for packaging, textiles

- Paints/Coatings, Solvents, Rubbers, Adhesives, Surfactants, Dyes comprise varied industrial uses

By End‑Use Industry

- Packaging: ~38% segmentshare in 2024

- Automotive & Transportation: Uses lightweight composites and plastics.

- Construction, Electronics, Healthcare, Agriculture, Textiles all rely heavily on petrochemical-derived materials

Key Market Drivers

- Diversifying Oil Demand: With fuel usage tapering, petrochemicals now represent ~15% of oil demand—rising to 19% by 2035

- Population & Urban Expansion: Growth in packaging, electronics, textiles, and vehicle production fuels petrochemical use .

- Industrial Growth in Asia: China, India, and Southeast Asia lead investments in refining and petrochemical capacity .

- Sustainability Push: Shift toward recycled and bio-based petrochemicals—investments by Dow and SABIC

- Technological Progress: Catalytic innovation, digital process optimization, and recycling technologies reducing energy and cost.

- Rising Plastics Consumption: Plastics are lightweight, durable, and cost-effective, making them ideal for packaging, construction, and consumer goods.

- Automotive and Mobility: Modern vehicles rely on plastic parts and synthetic rubbers to reduce weight and improve fuel efficiency.

- Electronics Boom: Smartphones, computers, and appliances use various resins and polymers.

- Pharmaceuticals and Healthcare: Petrochemicals produce key ingredients in drugs and medical devices.

- Economic Recovery: As global economies rebound, industrial activity—and thus demand for petrochemicals—surges.

Challenges & Barriers

- Feedstock Price Volatility: Crude oil instability directly impacts costs, margins, and investment

- Environmental Regulations: Plastic bans and emissions controls squeeze production economics

- Overcapacity & Competition: Infrastructure build-out leaves oversupply, pressuring margins .

- Barriers to Renewable Feedstocks: Bio-based alternatives remain expensive and niche

Technological Trends & Innovation

- Bio-based & Recycled Polymers: SABIC and Dow investing in circular economy solutions

- Chemical Recycling: Converting plastics back to monomers, supported by Exxon and Dow .

- AI & IoT in Process Optimization: Digital transformation reduces downtime and emissions .

- Cleaner Process Technologies: KBR’s and others’ investments in low-carbon cracking and hydrogen-fired furnaces

Competitive Landscape

Major global players include BASF, ExxonMobil, Dow, Shell, SABIC, INEOS, LyondellBasell, Chevron Phillips, Reliance, Mitsubishi Chemical, CNPC, Indian Oil, TotalEnergies Companies differentiate via feedstock integration, sustainable tech investments, and Asia-Pacific capacity expansion.

SWOT Analysis

Strengths

- Core material base for multiple industries

- Global scale and vertical integration

- Emerging investments in recycling and bio-feedstocks

Weaknesses

- Profitability tied to oil market swings

- Vulnerable to public scrutiny and regulation

- Cost of adopting sustainable alternatives may outweigh short-term gains

Opportunities

- Chemical recycling and circular economy

- Bio-based feedstocks and advanced separation tech

- Digital transformation for cost and emission reduction

Threats

- More plastic bans and stricter emissions

- Economic slowdowns impacting downstream demand

- Overcapacity depresses margins and investment returns

Market Segmentation

The petrochemicals market breaks down by product type:

-

Olefinic Chemicals: Ethylene and propylene used to make polyethylene and polypropylene plastics.

-

Aromatic Chemicals: Benzene, toluene, and xylene for fibers, solvents, and resins.

-

Other Petrochemicals: Specialty products like butadiene, styrene, and methanol.

Ethylene leads in volume, as polyethylene is the world’s most common plastic. Propylene and aromatics follow closely, each serving vast industrial applications. Understanding which segment dominates helps firms target the fastest-growing niches.

Regional Insights

Growth is uneven across regions:

-

Asia Pacific: Holds the largest share, driven by China and India’s expanding manufacturing sectors precedenceresearch.com.

-

North America: Strong shale gas supply gives U.S. producers a cost advantage straitsresearch.com.

-

Europe: Faces higher energy costs and tighter environmental rules, putting pressure on margins ft.com.

Emerging markets in Latin America and the Middle East are also investing in new petrochemical plants to diversify their oil and gas revenues. Regional data lets businesses decide where to build new facilities or expand capacity.

Industry Challenges

Despite healthy growth, the petrochemicals market must navigate:

-

Volatile Oil Prices: Feedstock cost swings can compress profits when crude prices spike.

-

Trade Tensions: New tariffs can cut demand for packaged goods and disrupt supply chains reuters.com.

-

Environmental Pressure: The industry produces around 5–6% of global greenhouse gases, prompting calls for cleaner processes reuters.com.

-

Regulatory Hurdles: Stricter rules on emissions and waste mean higher compliance costs, especially in Europe and North America.

These challenges drive firms to invest in efficiency, feedstock flexibility, and greener technologies to stay competitive.

Future Outlook & Opportunities

- Circular petrochemicals: Recycling technologies will create closed-loop supply chains.

- Bio-feedstock adoption: Renewable alternatives will grow for polymers and solvents.

- Digital-driven efficiency: AI/IoT-enabled plants to become mainstream.

- Emerging market growth: Asia, MEA, Latin America expanding demand.

- Green process engineering: Low-carbon hydrogen cracking and carbon capture will gain importance.

Conclusion

The petrochemicals market remains a cornerstone of modern economies, supplying the raw materials for packaging, transport, construction, healthcare, and more. With a projected valuation of up to USD 1.34 trillion by 2034, the industry stands at a pivotal crossroads—balancing traditional growth with sustainability, technological innovation, and shifting public expectations.

To thrive, companies must master digital optimization, adopt circular practices, diversify feedstocks, and navigate evolving regulations. Those that succeed will shape not just the future of manufacturing—but also the trajectory of global sustainability and resource management.

Get More Details : https://www.databridgemarketresearch.com/reports/global-petrochemicals-market