Sendwave has quickly become a trusted app for instant international money transfers, specifically designed to cater to individuals sending money to Africa and Asia. With a focus on fast, secure, and low-cost remittances, Sendwave stands out among its competitors. This article will explore Sendwave’s features, benefits, and recent developments, including its acquisition by WorldRemit and regulatory challenges with the Consumer Financial Protection Bureau (CFPB). For anyone wondering, “Is Sendwave safe?” or “How does Sendwave compare to other transfer services?” this article will provide a comprehensive answer.

1. What is Sendwave? An Overview

Sendwave is a mobile application that allows users to send money to African and Asian countries at low fees and with competitive exchange rates. The app offers a simple, user-friendly platform where users can send funds directly to bank accounts or mobile wallets with just a few clicks.

How Sendwave Works

- Download the app from Google Play or Apple App Store.

- Register your account by adding personal information for verification.

- Enter the recipient’s details, including bank or mobile wallet information.

- Select the amount and currency, confirm the transaction, and send!

Key Features

- Instant international money transfers to Africa and Asia

- Low or zero transfer fees

- Direct transfers to mobile wallets or bank accounts

- 24/7 availability with responsive customer support

2. Sendwave’s Acquisition by WorldRemit and Zepz

In 2020, WorldRemit, a major cross-border payments company, acquired Sendwave to extend its presence in the remittance market. The acquisition also led to the formation of a new brand, Zepz, which now serves as the parent company of both Sendwave and WorldRemit. This partnership enhances Sendwave’s capacity to provide low-cost, reliable remittances and positions it as a leading money transfer service.

Impact of the Acquisition

The acquisition brought improvements to Sendwave, including access to a broader network of financial institutions and increased security features. WorldRemit’s extensive international reach has enabled Sendwave to expand its services and ensure greater reliability for users.

3. Regulatory Challenges and CFPB Action

In 2023, the Consumer Financial Protection Bureau (CFPB) imposed fines on Chime Inc., the operator of Sendwave, citing misleading claims about the speed and cost of transfers and inadequate customer support. This action was a wake-up call for Sendwave to align its services with regulatory standards, enhance transparency, and prioritize consumer protection.

Understanding Sendwave’s Compliance with Financial Regulations

Since the CFPB intervention, Sendwave has taken steps to ensure better compliance with financial regulations and improve its transparency regarding fees, processing times, and exchange rates. Users can now expect clearer disclosures and more responsive customer support.

4. Benefits of Using Sendwave for Money Transfers

Here are some of the core benefits that make Sendwave an excellent choice for international remittances:

Instant Transfers to Supported Countries

Sendwave’s transfers are nearly instantaneous, particularly for mobile wallet transactions. This feature makes Sendwave ideal for urgent transfers or emergencies.

Affordable Transfer Fees

Sendwave offers low or no fees for many transfer routes. This affordability is particularly beneficial for users sending smaller amounts, where fees might otherwise eat into the transfer value.

Competitive Exchange Rates

The app offers competitive exchange rates, often better than traditional banks or wire transfers. This means users get more value per dollar sent.

Example: A user sending money from the U.S. to Nigeria may see a significant difference in received funds due to Sendwave’s favorable rates compared to a traditional bank.

Secure Transactions

Sendwave prioritizes the security of every transaction. With end-to-end encryption and compliance with data protection laws, users can trust their funds are handled safely.

5. How to Use Sendwave: Step-by-Step Guide

- Download the App: Available for both iOS and Android.

- Create an Account: Register with your phone number and complete identity verification.

- Add a Payment Method: Link your debit or credit card for quick payments.

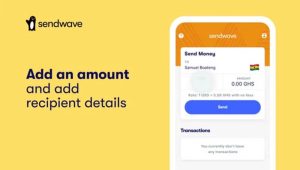

- Choose Recipient Details: Enter their bank account or mobile wallet information.

- Enter Amount and Send: Confirm the amount and transfer currency.

- Receive Confirmation: Both sender and recipient get notifications upon successful transfer.

Example Use Case:

Consider Mary, who lives in the U.S. and wants to send $200 to her family in Kenya. Using Sendwave, she quickly completes the transaction without paying hefty fees, and her family receives the funds in their mobile wallet within minutes.

6. Sendwave vs. Other Remittance Apps

When comparing Sendwave to other remittance services like Remitly, Wise, or PayPal, the following factors come into play:

Speed: Sendwave typically processes transfers instantly, which can be faster than some services that take several days.

Fees: With low or zero fees, Sendwave is competitive against services like Western Union, which often have higher costs.

Exchange Rates: Compared to banks and traditional wire transfers, Sendwave offers better exchange rates, maximizing the recipient’s received amount.

Transparency: The CFPB action has led Sendwave to improve transparency around fees, addressing previous complaints about hidden costs.

7. Drawbacks and Considerations

While Sendwave is convenient, it’s essential to be aware of a few potential drawbacks:

Limited Coverage:

Sendwave primarily focuses on African and select Asian countries. Users who wish to send money to Europe or Latin America may need another service.

Card-Based Transfers Only:

Sendwave only supports debit and credit card payments. Some users may prefer other payment options, like bank transfers or cash pickup.

Customer Support Issues:

Although customer support has improved since the CFPB ruling, some users report delays in getting help.

8. Common Questions about Sendwave

Is Sendwave Safe to Use?

Yes, Sendwave is generally safe. The app uses secure encryption and complies with regulatory standards. However, it’s essential to check transfer details carefully and contact customer support if any issues arise.

Does Sendwave Charge Hidden Fees?

Since the CFPB action, Sendwave has become more transparent about fees. Users can expect clear disclosures and accurate transfer information.

How Long Do Transfers Take with Sendwave?

Most transfers are processed instantly, especially to mobile wallets. However, bank transfers may take longer, depending on the recipient’s bank.

9. Future of Sendwave: Enhancements and Expansions

Sendwave’s partnership with WorldRemit and parent company Zepz has set the stage for potential expansion into new regions, services, and improvements. Users can expect a more reliable platform, especially as Sendwave enhances its regulatory compliance and transparency.

10. Tips for Maximizing Value with Sendwave

Here are some tips to make the most out of Sendwave’s services:

- Compare Exchange Rates: While Sendwave usually offers favorable rates, compare rates for high-value transfers to ensure the best deal.

- Set Up Notifications: Enable notifications to track transfer statuses and get real-time updates.

- Understand Your Limits: Some countries have transaction limits; make sure to check these before sending large amounts.

- Use Customer Support Proactively: If you have issues, reach out early for faster resolution.

Conclusion

Sendwave remains a trusted, convenient, and affordable option for anyone looking to send money to Africa and Asia. Despite regulatory challenges, Sendwave continues to enhance its service offerings, focusing on transparency and user satisfaction. Whether it’s the ease of use, low fees, or fast transfer times, Sendwave meets the needs of many in the diaspora who want to support loved ones abroad.