Impact of Political Instability on Stock Prices

Political instability disrupts financial markets and stock prices. When a country experiences political instability, such as a government shutdown, election uncertainty, or civil unrest, it often results in a significant disruption of financial markets. This disruption can cause stock prices to fluctuate wildly as investors react to the uncertainty and potential for changes in economic policy. For instance, during periods of political instability, investors may become wary of taking on additional risk, leading to a sell-off in stocks and a subsequent decline in stock prices. This reaction is typically driven by fears that the instability could lead to economic downturns, policy changes that negatively impact businesses, or other adverse economic conditions.

Uncertainty in governance impacts stock markets adversely. When there is uncertainty in governance, such as unclear election outcomes or leadership changes, it can have a profoundly adverse effect on financial markets. Investors generally prefer stable and predictable political environments because they provide a clearer outlook for future economic conditions and policy directions. When governance is uncertain, it creates a riskier environment for investments, prompting investors to seek safer assets or withdraw from the market altogether. This flight to safety can cause stock prices to drop as demand for equities decreases, further exacerbating the volatility in financial markets.

Government Policies and Market Reactions

Government policies influence financial markets’ stability and confidence. The policies enacted by a government play a crucial role in shaping the stability and confidence of financial markets. For example, fiscal policies such as tax reforms, government spending, and regulatory changes can have a direct impact on market sentiment and investor behavior. Positive policies that promote economic growth and stability can boost investor confidence, leading to a rise in stock prices and overall market stability. Conversely, policies perceived as harmful to economic growth or business interests can erode confidence and lead to market declines.

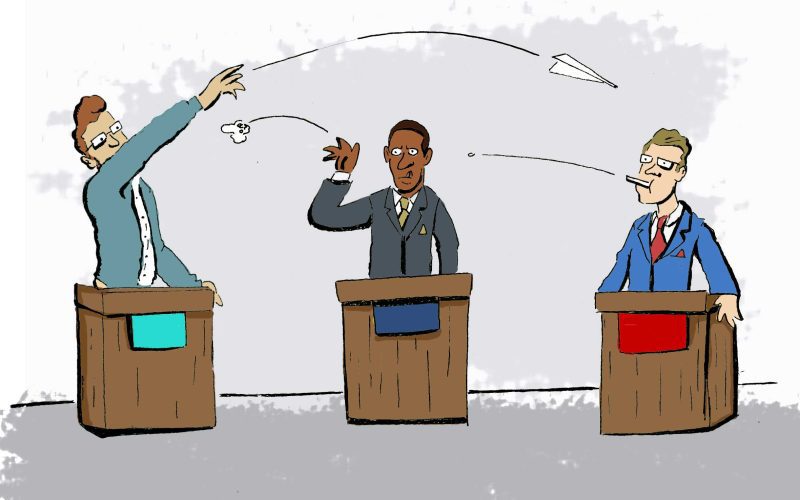

Political turmoil causes volatility in financial markets. During times of political turmoil, financial markets often experience heightened volatility. This is because political events can create significant uncertainty about future economic policies and conditions. For instance, political crises such as impeachment proceedings, mass protests, or geopolitical conflicts can lead to rapid changes in investor sentiment. This uncertainty can cause sharp swings in stock prices, bond yields, and currency values as investors react to the evolving political landscape. The resulting volatility can make it challenging for investors to navigate the market and make informed decisions.

Investor Sentiment During Political Crises

When investors perceive that a political crisis could lead to negative economic outcomes, their sentiment often turns bearish. This shift in sentiment can trigger a wave of selling, leading to declines in stock prices and increased market volatility. Conversely, if investors believe that a political crisis will be resolved favorably or that it will not have a significant impact on the economy, their sentiment may remain stable or even become bullish, helping to support market stability.

Political turmoil leads to volatility in financial markets. Political turmoil, such as leadership changes, policy uncertainty, or geopolitical tensions, can lead to significant volatility in financial markets. This is because political events can create uncertainty about future economic policies and conditions, which in turn affects investor behavior. For example, during a political crisis, investors may become more risk-averse, leading to a sell-off in riskier assets such as stocks and a flight to safer assets such as bonds or gold. This shift in investor behavior can cause sharp fluctuations in asset prices and increased market volatility.

Currency Fluctuations in Unstable Political Climates

Currency volatility impacts global financial markets significantly. In times of political instability, currency markets often experience significant volatility. Currency values are highly sensitive to changes in political conditions because they reflect investor perceptions of a country’s economic stability and future prospects. When political instability arises, it can lead to rapid fluctuations in currency values as investors react to the perceived risks. These fluctuations can have a ripple effect on global stock markets, impacting everything from trade balances to investment flows.

Political instability drives uncertainty in stock markets. Political instability can create a high degree of uncertainty in financial markets, which in turn drives currency volatility. For example, political events such as elections, government shutdowns, or geopolitical conflicts can lead to uncertainty about future economic policies and conditions. This uncertainty can cause investors to reassess their currency positions, leading to sharp movements in exchange rates. The resulting currency volatility can create challenges for businesses and investors, as it affects the cost of imports and exports, the value of foreign investments, and overall market stability.

Bond Market Responses to Political Events

Political events impact bond yields in financial markets. Bond markets are highly sensitive to politics events, as changes in political conditions can influence investor perceptions of risk and future interest rates. For example, during times of political instability, investors may seek the safety of government bonds, driving up demand and pushing down yields. Conversely, if political events lead to concerns about a government’s ability to meet its debt obligations, it can result in higher yields as investors demand a risk premium. The impact of political events on bond yields can have significant implications for borrowing costs, investment returns, and overall market stability.

Financial markets react swiftly to political instability. Financial markets are known for their rapid response to political instability. When political events create uncertainty or risk, markets often react quickly as investors adjust their portfolios to reflect the new conditions. This swift reaction can lead to sharp movements in asset prices, including bonds, as investors seek to manage their exposure to political risk. For example, during a political crisis, bond yields may spike as investors demand higher returns for taking on additional risk, or they may fall if investors flock to the safety of government bonds. The speed and magnitude of these reactions underscore the importance of political stability for financial market confidence.

Role of Central Banks in Political Turmoil

Central Banks stabilize financial markets during political crises. Central banks play a crucial role in stabilizing stock markets during times of political turmoil. Through monetary policy tools such as interest rate adjustments, open market operations, and liquidity provisions, central banks can help to mitigate the impact of political instability on stock markets. For example, during a political crisis, a central bank may lower interest rates to support economic activity and boost investor confidence. Additionally, central banks can provide liquidity to financial institutions to ensure the smooth functioning of financial markets and prevent panic selling.

Political turmoil challenges Central Banks’ influence on stock markets. While central banks have a range of tools at their disposal to stabilize financial markets, political turmoil can pose significant challenges to their effectiveness. For instance, if political instability leads to a loss of confidence in government institutions or creates uncertainty about future economic policies, it can undermine the central bank’s efforts to stabilize markets. Additionally, political pressure on central banks to take certain actions or refrain from others can complicate their ability to respond effectively to market conditions. Despite these challenges, central banks remain a key player in managing the impact of political turmoil on financial markets.

Comparative Analysis of Different Regions

Impact of political turmoil on regional financial markets. The impact of political turmoil on stock markets can vary significantly across different regions. For example, developed markets such as the United States and Europe may be more resilient to political instability due to their established institutions and diversified economies. In contrast, emerging markets may be more vulnerable to political turmoil, as they often have less developed financial systems and higher levels of economic and political risk. Understanding the regional differences in how financial markets respond to political events is crucial for investors seeking to manage their exposure to political risk.

Comparative resilience of financial markets to political instability. stock markets in different regions exhibit varying degrees of resilience to political instability. Developed markets, with their robust legal frameworks, strong institutions, and diversified economies, tend to be more resilient to political instability. These markets can often absorb political shocks without experiencing prolonged periods of volatility. On the other hand, emerging markets, which may have weaker institutions and higher levels of political and economic risk, can be more susceptible to prolonged market disruptions during times of political turmoil. This comparative analysis highlights the importance of considering regional factors when assessing the impact of political events on stock markets.

Case Studies of Historical Political Events

Impact of Brexit on Financial Markets. The Brexit referendum in 2016 serves as a compelling case study of how political events can impact stock markets. The unexpected vote for the United Kingdom to leave the European Union created significant uncertainty about the future economic relationship between the UK and the EU. This uncertainty led to sharp declines in the British pound, increased volatility in stock markets, and shifts in bond yields as investors reassessed their risk exposure. The long-term negotiations and political debates surrounding Brexit continued to influence financial markets for years, underscoring the lasting impact of major political events.

2008 Financial Crisis and Political Responses. The 2008 financial crisis provides another example of the interplay between political events and stock markets. The crisis, which originated in the U.S. housing market, quickly spread to global stock markets, leading to widespread panic and significant economic downturns. In response, governments and central banks around the world implemented a range of policy measures to stabilize stock markets and support economic recovery. These measures included unprecedented monetary easing, fiscal stimulus packages, and regulatory reforms. The political responses to the crisis played a crucial role in shaping the recovery trajectory and restoring confidence in stock markets.

Conclusion:

In conclusion, political turmoil has a profound impact on stock markets s, influencing everything from stock prices and bond yields to currency values and investor sentiment. Understanding the various ways in which political instability can affect financial markets is essential for investors, policymakers, and financial institutions as they navigate the complexities of a rapidly changing global landscape.