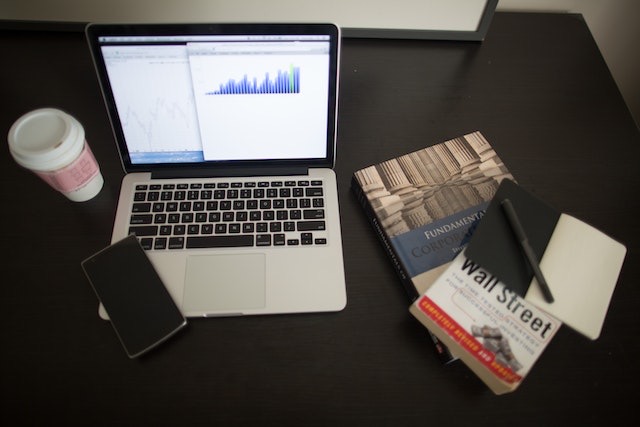

In an ever-changing investment landscape, real estate has long remained a steadfast and lucrative option for wealth accumulation. With its potential for long-term appreciation, consistent cash flow, and tax benefits, investing in real estate has captured the attention of both seasoned investors and newcomers seeking to diversify their portfolios. In this feature, we explore proven strategies for leveraging real estate investments to build sustainable long-term wealth.

- Understanding the Market:

Before diving into real estate investment, one must grasp the dynamics of the market. Conducting thorough research, analyzing local trends, and keeping a finger on the pulse of the industry are essential steps. For instance, studying demographic shifts, infrastructure developments, and economic indicators can provide valuable insights into future growth potential and demand for properties.

- Choosing the Right Investment Strategy:

Real estate investments come in various forms, each with its own benefits and risks. The three primary strategies include:

a. Rental Properties: Acquiring residential or commercial properties to generate rental income can offer a stable cash flow stream. Selecting properties in high-demand areas with strong rental markets and favorable rental laws is crucial for long-term profitability.

b. Fix and Flip: This strategy involves purchasing distressed properties, renovating them, and selling them for a profit. Timing, market conditions, and an understanding of construction costs are essential factors for successful execution.

c. Real Estate Investment Trusts (REITs): REITs provide investors with an opportunity to pool resources and invest in real estate projects managed by professionals. REITs offer the advantage of liquidity and diversification, making them an attractive option for those seeking a hands-off approach.

- Financing and Risk Management:

Securing adequate financing is a critical aspect of real estate investment. Investors can choose between conventional mortgages, private lenders, or partnerships to fund their ventures. Conducting thorough due diligence, including property inspections and market assessments, can mitigate risks associated with unforeseen repairs, zoning restrictions, or declining property values.

- Portfolio Diversification:

As with any investment strategy, diversification is key to managing risk. Combining different types of real estate investments, such as residential, commercial, or industrial properties, can help balance the portfolio and protect against market volatility. Additionally, considering geographic diversity can further safeguard against localized economic downturns.

- Adhering to Ethical Practices:

Real estate investors must adhere to ethical standards throughout their endeavors. Honesty, transparency, and fair dealing with tenants, partners, and contractors are essential for maintaining a positive reputation in the industry. Complying with local laws, regulations, and property codes is not only a legal obligation but also a way to build trust and foster long-term success.

Opinion Piece: The Resilience of Real Estate as an Investment Avenue

In a world of volatile financial markets and unpredictable economic shifts, real estate stands tall as a bastion of stability. Unlike stocks or cryptocurrencies, properties offer a tangible asset with intrinsic value. The ability to generate consistent income through rentals, along with the potential for capital appreciation over time, makes real estate a compelling option for investors seeking long-term wealth.

Furthermore, real estate investments provide a level of control and autonomy that few other investment vehicles can match. Investors have the power to improve their properties, optimize cash flow, and make strategic decisions based on market conditions. While other investments may be subject to external factors beyond one’s control, real estate offers a degree of influence that can be harnessed for optimal returns.